SoftBank cashes out $5.8bn Nvidia stake to fund OpenAI bet

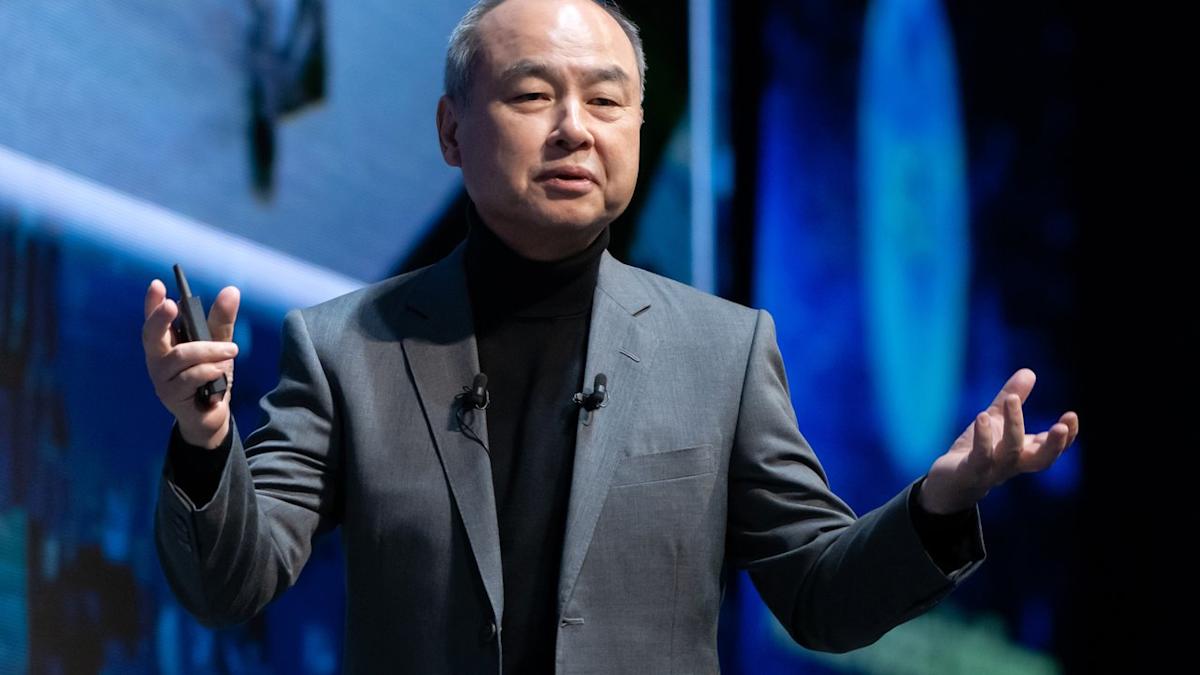

Masayoshi Son’s SoftBank surprised investors when it said it had sold its entire Nvidia stake for about $5.83 billion to help fund more bets on AI.

The Tokyo-based conglomerate said it offloaded roughly 32 million shares in the U.S. chipmaker last month as it builds up capital for its expanding investment in OpenAI. Nvidia shares slipped 1.5% in early U.S. trading Tuesday.

Chief financial officer Yoshimitsu Goto said in translated comments that the decision was “nothing to do with Nvidia itself.” He said: “This year our investment in OpenAI is large, more than $30 billion needs to be made. For that we do need to divest our existing portfolios.”

He added: “We want to provide a lot of investment opportunities for investors, while we can still maintain financial strength.”

SoftBank’s results for the six months to September showed profits almost tripled from a year earlier, climbing to about 2.5 trillion yen ($13 billion). Revenue grew 7.7% to 3.7 trillion yen ($24 billion).

A $19 billion profit from the group’s Vision Fund partly fuelled those gains, reflecting higher valuations in tech and AI stocks in general. The fund has been expanding across AI including in semiconductors, robotics, and large language models.

“The reason we were able to have this result is because of September last year, that was the first time we invested in OpenAI,” Goto said.

SoftBank’s founder Masayoshi Son has been positioning the group as a central player in global AI development. In February, he appeared with President Donald Trump, OpenAI’s Sam Altman, and Oracle co-founder Larry Ellison to unveil a planned $500 billion AI infrastructure project called Stargate.

But it also comes as concerns grow about an overheated AI market, as tech firms pour billions into new projects. Some investors have warned that valuations have raced ahead of real-world profits. When asked about those fears, Goto said: “I can’t say if we’re in an AI bubble or not.”

Leave a Comment

Your email address will not be published. Required fields are marked *