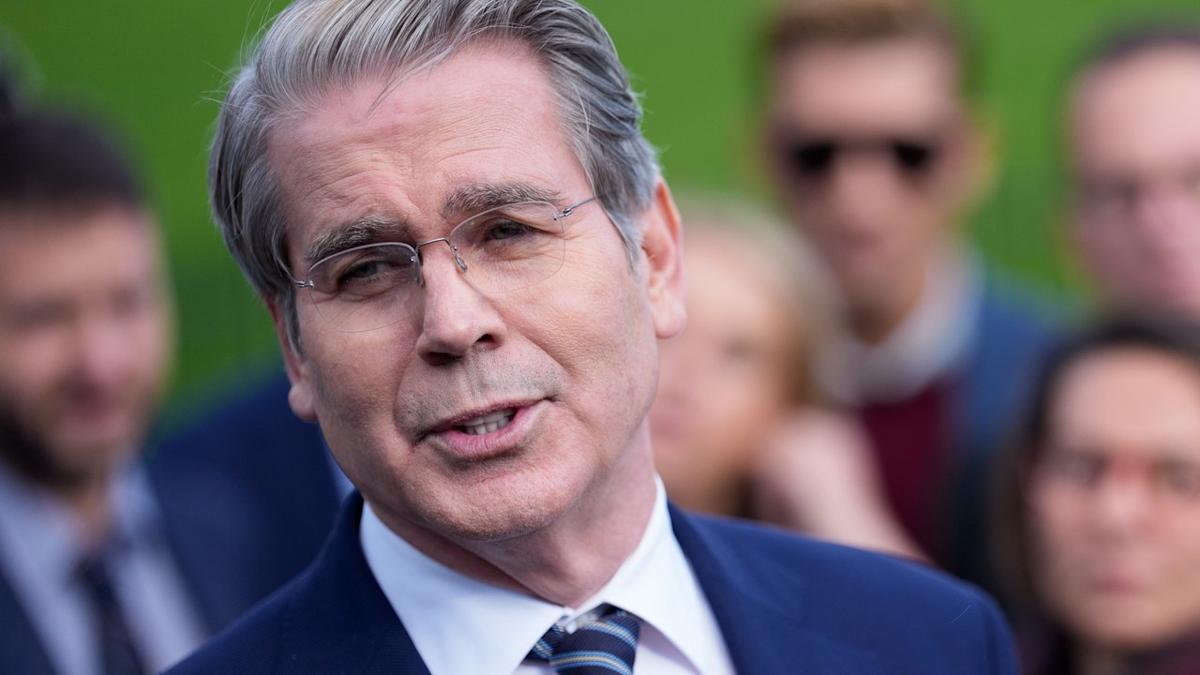

Scott Bessent says parts of the economy are ‘in recession’

Treasury Secretary Scott Bessent warned on Sunday that some parts of the U.S. economy have already slipped into an economic downturn.

“I think we are in good shape, but I think that there are sectors of the economy that are in recession,” Bessent told CNN host Jake Tapper, arguing that “the Fed has caused a lot of distributional problems with their policies.”

Bessent issued a fresh call for the Fed to lower interest rates to ease mortgage costs and “end this housing recession.” He didn’t specify which other parts of the economy are in a recession.

Bessent’s remarks come shortly after the Fed slashed borrowing costs for the second time this year. He is the second Trump official to cast blame on the Fed for a possible recession, even as most analysts believe tariffs are dragging down the economy.

The central bank has operated without the usual economic data to inform its decision-making for the past month. The ongoing government shutdown has virtually closed the Bureau of Labor Statistics, so it is unable to collect and assemble the data released on a monthly basis regarding consumer prices, employment growth, and more.

Fed Chair Jerome Powell on Wednesday acknowledged a split among members of the Federal Open Market Committee — the body tasked with deciding interest rates — on whether to sit still or lower more in December. He described the possibility of a third interest rate cut as “not a foregone conclusion. Far from it.”

Fed Governor Stephen Miran, who still has ties to the White House, told the New York Times in an interview published Saturday that the Fed could spark a recession if it doesn’t slash interest rates by half a percentage point further. That rate cut amount exceeds what most voting members of the FOMC support at the moment.

The current Fed interest rate is kept between 3.75% and 4.00%.

Miran’s view aligns with President Donald Trump. He has repeatedly demanded that the Fed rapidly lower borrowing costs and trashed Powell for most of the summer.

Leave a Comment

Your email address will not be published. Required fields are marked *