Fed’s Miran says he can’t base policy stance on buoyant financial markets

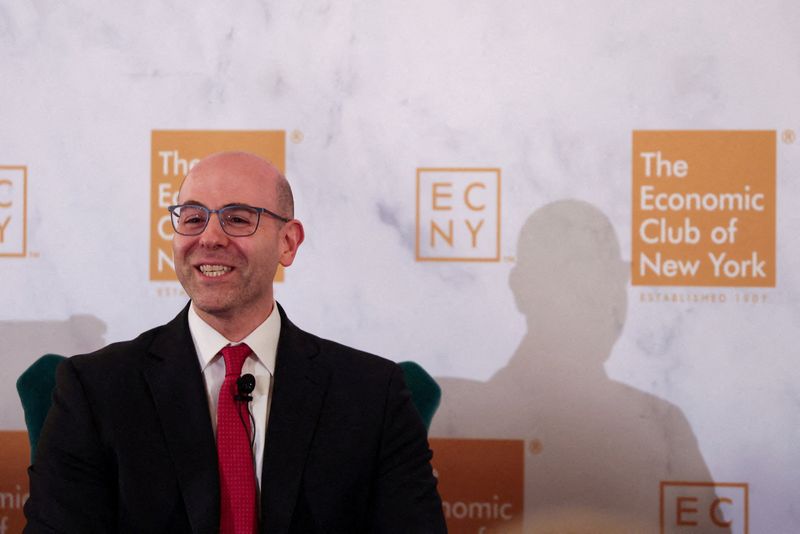

WASHINGTON (Reuters) -Federal Reserve Governor Stephen Miran said on Monday it is wrong to put too much emphasis on the strength of equity and corporate credit markets in assessing monetary policy that he feels remains too restrictive and is heightening the risk of a downturn.

“Financial markets are driven by a lot of things, not just monetary policy,” Miran said on the Bloomberg Surveillance television program, in explaining why he dissented last week against a quarter-percentage-point rate cut in favor of a half-percentage-point reduction.

Rising equity prices, narrow corporate credit spreads, and other factors don’t “necessarily tell you anything about the stance of monetary policy” at a moment when interest-sensitive sectors like housing are less buoyant and some parts of the private credit market appear under stress.

Miran’s remarks highlight the competing views that Fed officials have begun to offer about the state of the economy and the risks facing it since last week’s divided decision to reduce the U.S. central bank’s benchmark policy rate by a quarter of a percentage point to the 3.75%-4.00% range.

The 10-2 policy vote marked only the third time since 1990 that voting Fed members have objected in favor of both tighter and looser monetary policy, and Fed Chair Jerome Powell’s remarks at his post-meeting press conference indicated an even deeper divide as he noted the “strongly differing views about how to proceed” at the central bank’s December 9-10 meeting.

It was an unusual reference to action at an upcoming meeting, with Powell emphasizing that another rate cut “is not a foregone conclusion – far from it.”

SCHMID LAYS OUT CASE FOR KEEPING MORE FOCUS ON INFLATION

Kansas City Fed President Jeffrey Schmid, who dissented in favor of no rate cut last week, laid out on Friday the case for keeping more of a focus on inflation that remains above the central bank’s 2% target, including the fact that “financial markets appear to be easy across many metrics. Equity markets are near record highs, corporate bond spreads are very narrow, and high-yield bond issuance is high. None of this suggests that financial conditions are particularly tight or that the stance of policy is restrictive.”

Asked specifically about the arguments cited by Schmid, a career banker, Miran said it overlooked stress that may be developing elsewhere in the financial system and the sluggishness in the housing market.

In addition, repeating arguments he has laid out since joining the Fed while on leave as a top economic adviser to President Donald Trump, Miran said the economy has been buffeted by population changes and other shocks since last year that have lowered underlying interest rates and mean “that policy has passively tightened” despite the Fed’s rate cuts. He said he continues to think the Fed should cut in half-percentage-point increments until hitting a “neutral” level he estimates is “quite a ways below” where it is now.

Leave a Comment

Your email address will not be published. Required fields are marked *