Indian Tech Stocks Decline on US Changes to H-1B Visa Program

(Bloomberg) —

Indian tech stocks declined on Monday on concern that US President Donald Trump’s hefty fee for new H-1B visas may lead to operational difficulties for outsourcing giants.

Most Read from Bloomberg

Trump’s overhaul of the program, by mandating a $100,000 fee for new applications, may disrupt projects of Indian outsources like Tata Consultancy Services Ltd. and Infosys Ltd. that derive a large chunk of revenue from the US.

TCS shares fell as much as 3.4%, the most in more than two months, while Infosys slipped as much as 3.9%. Tech Mahindra Ltd. declined 6.5%. Most stocks pared their declines later as analyst say the fact that fee hikes only apply to new visa applications means the impact on the sector would be limited.

The most likely scenario is large IT companies will increase offshoring, leaving no financial impact on them, according to a JM Financial note. “Importantly, with one of the biggest regulatory overhangs now behind, this event is net positive, in our view,” it said.

India’s IT services sector has already taken a hit from disappointing earnings for the April-June quarter and layoff plans by bellwether TCS, as customers curtailed technology spending amid flaring trade tensions. A gauge tracking the sector is down more than 18% this year, compared to the NSE Nifty 50 Index’s 6.5% gain.

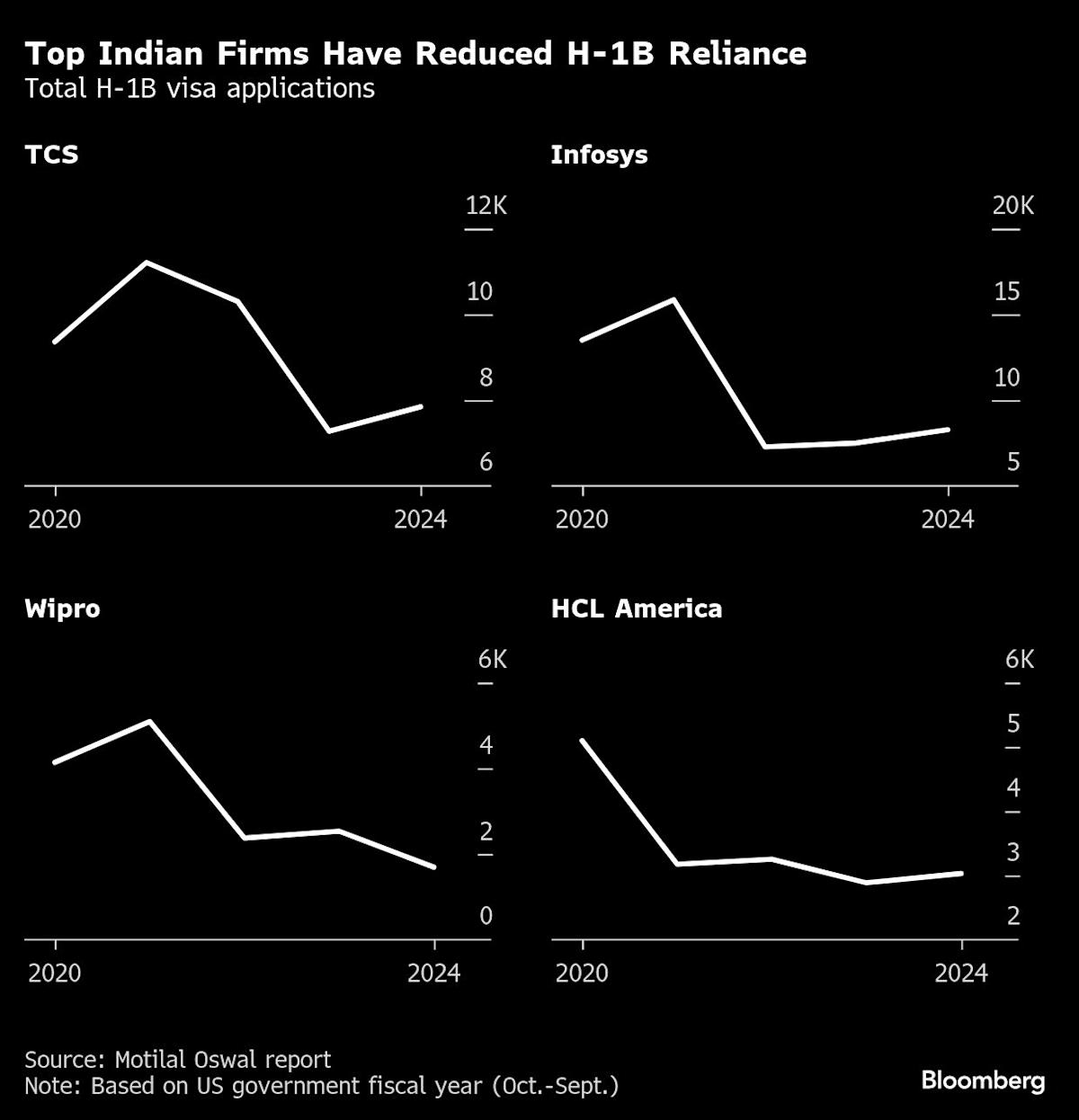

Even so, smaller IT companies may take a bigger hit due to a higher dependency on the visa compared larger firms, which have reduced their exposure over the past few years, according to analysts. LTIMindtree Ltd. and Mphasis Ltd. shares declined by about 6% each. Larger firms have already been reducing reliance on H-1B visas.

“Companies will be forced to redesign their pricing plans to either offer an expensive onshore consulting model or a much cheaper offshore program where most of the work will be done outside the US,” Bloomberg Intelligence analysts Anurag Rana and Andrew Girard said.

Here’s what market watchers are saying:

Citi (strategists including Surendra Goyal)

-

Within IT companies, HCL Technologies and Infosys said earlier this year that 80% and 60%-plus of their US workforce is visa independent; companies with less US exposure will obviously be relatively less impacted

-

The impact will be largely visible starting in fiscal year 2027; some of it may be offset by higher outsourcing to India and lower outflow from education if Indian students refrain from studying abroad

Leave a Comment

Your email address will not be published. Required fields are marked *