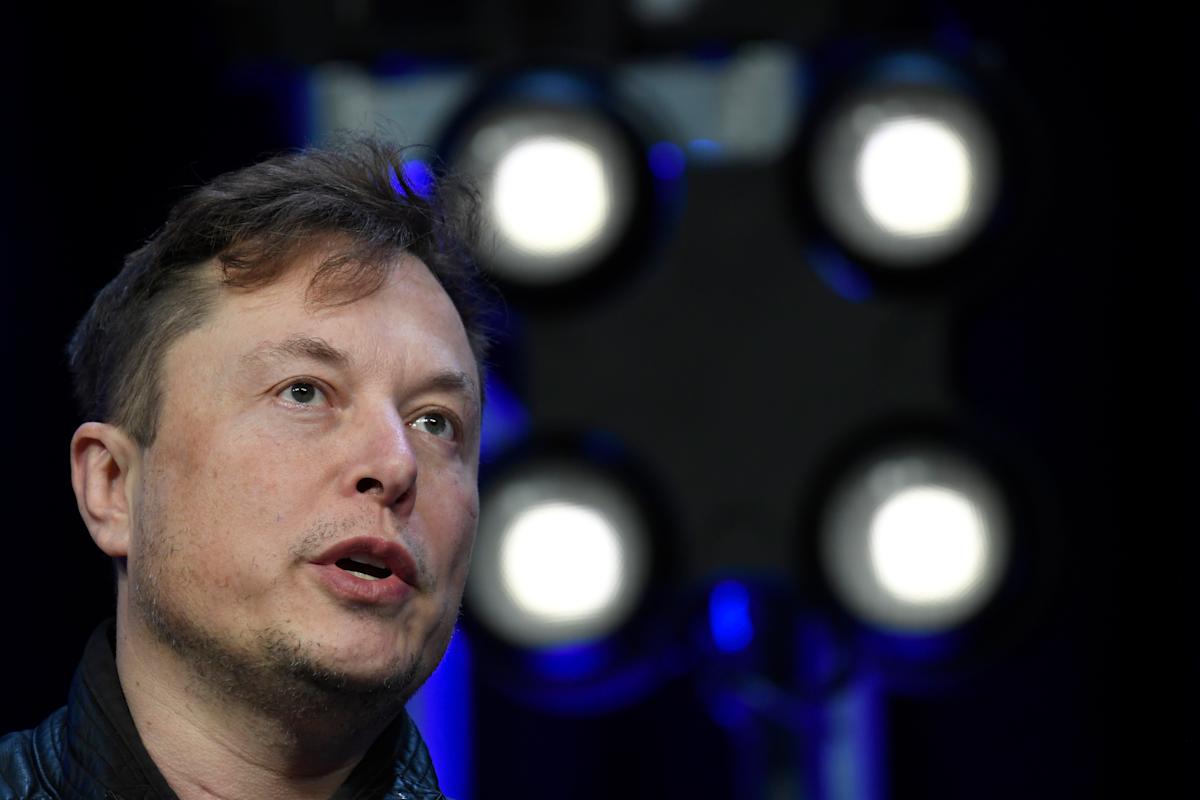

Musk’s X Shows Weaker Sales After Initial Post-Election Surge

(Bloomberg) — Sales at Elon Musk’s X dropped slightly during the second quarter from the first quarter, signaling that the social network has struggled to build on the spending that rushed in when Musk was at the center of US politics.

The social network, formerly known as Twitter, posted about $707 million in revenue in the three-month period through June 30, a 2.2% drop compared to the first three months of the year, according to people briefed on the numbers. Still, that’s more than a 20% increase in sales from the same period in 2024, partly helped by the election and post-campaign surge, when Musk was spending much of his time directly alongside President Donald Trump.

Most Read from Bloomberg

A spokesperson for X didn’t reply to requests for comment. The numbers were disclosed to private investors last week.

After Trump’s November election win, Musk’s closeness to him helped draw investors to the company, and also pushed at least some advertisers to spend on X in hopes of currying favor with Musk and the administration.

Much has happened since then: The pair feuded publicly on social media, then Musk swore off politics and turned his focus to other parts of his empire, such as his artificial intelligence company xAI and his electric car maker, Tesla Inc.

The figures suggest that X’s business has started to stabilize after years of uncertainty following Musk’s initial takeover. Even so, revenue was down 40% from the same quarter in 2022, the last time Twitter reported earnings before going private, a sign that the business is still meaningfully smaller than it was.

Advertising, which historically had been the key growth driver of X’s business, has taken a back seat to subscriptions and data licensing products, Bloomberg reported.

On top of that, Linda Yaccarino, a long-time advertising veteran who was CEO of X, left in July, paving the way for the network to lean harder into a new identity as a source of data for artificial intelligence training, supporting xAI’s chatbot Grok.

The company’s business has fluctuated over the past year. X’s gross profit in the second quarter was down 24% from the first quarter of this year, but was still up more than 30% from the same quarter last year, the people said. The firm also boasted almost $360 million in ebitda, or annual earnings before interest, taxes, depreciation and amortization without financial adjustments. That’s also slightly down from the start of the year, but up 33% from last year’s second quarter.

Leave a Comment

Your email address will not be published. Required fields are marked *