AI Chipmaker Moore Threads Begins Trading After China’s Second-Biggest IPO

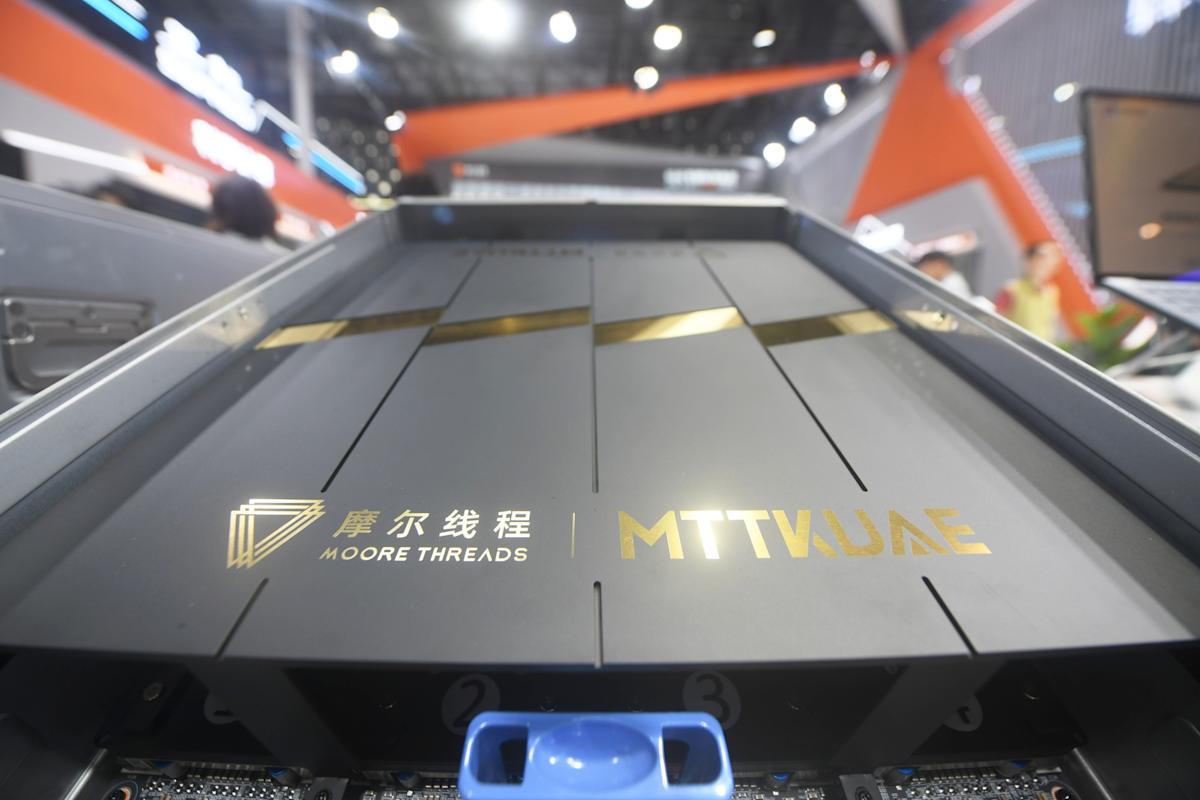

Source: CFOTO/Future Publishing/Getty Images

(Bloomberg) — Moore Threads Technology Co., a leading Chinese artificial intelligence chipmaker, will begin trading in Shanghai’s stock exchange on Friday in the year’s second-largest onshore IPO.

Most Read from Bloomberg

The Beijing-based firm raised nearly 8 billion yuan ($1.13 billion), valuing the company at about $7.6 billion. Interest in the offering was strong, with the retail portion oversubscribed 2,750 times even after a greenshoe option. That makes it the second most sought-after onshore initial public offerings over $1 billion since 2022, Bloomberg data shows.

The debut comes as optimism over China’s drive for tech self-sufficiency intensifies, fueled by trade tensions and fears of US technology curbs. The firm is also among those benefiting from a market share void left by Nvidia Corp.’s forced exit. Earlier this year, regulators eased listing rules for unprofitable firms on the Nasdaq-style Star Board to bolster homegrown startups.

Moore Threads has a competitive technological edge and can benefit from the “domestic substitution trend” given US trade frictions and Beijing’s push to develop national champions, Fan Zhiyuan, an analyst at Sinolink Securities Co. wrote in a note. It is also the only Chinese firm that can manufacture all-purpose graphics processing units, he added.

Proceeds from the IPO will fund next-generation projects in AI and graphics chips as well as supplement working capital. The offering ranks behind Huadian New Energy Group Co.’s $2.7 billion IPO in July.

Moore Threads’ net loss was 724 million yuan during the first three quarters of the year, Sinolink Securities added, narrowing by 19% from the year ago period. Meanwhile, revenue surged by 182% to 780 million yuan.

Still, its valuations remain lofty. Moore Thread’s price to sales ratio at 123 times the offer price of 114.28 yuan per share is higher than the average of 111 times for peers, according to a Dec. 4 filing. The company recently asked its lead sponsor to remind investors of risks related to its valuations.

Origins

Founded in 2020 by former Nvidia executive Zhang Jianzhong, Moore Threads had started out earning revenue from graphics chips for gaming and visual rendering before pivoting to AI accelerators used in powering large language models.

Leave a Comment

Your email address will not be published. Required fields are marked *