XRP Surges 8% as Ascending Triangle and Bullish RSI Cross Trigger Fresh Rally

XRP ripped through the crucial $2.10 resistance with an explosive volume surge, marking its strongest breakout in weeks as technical and on-chain catalysts finally aligned in the bulls’ favor.

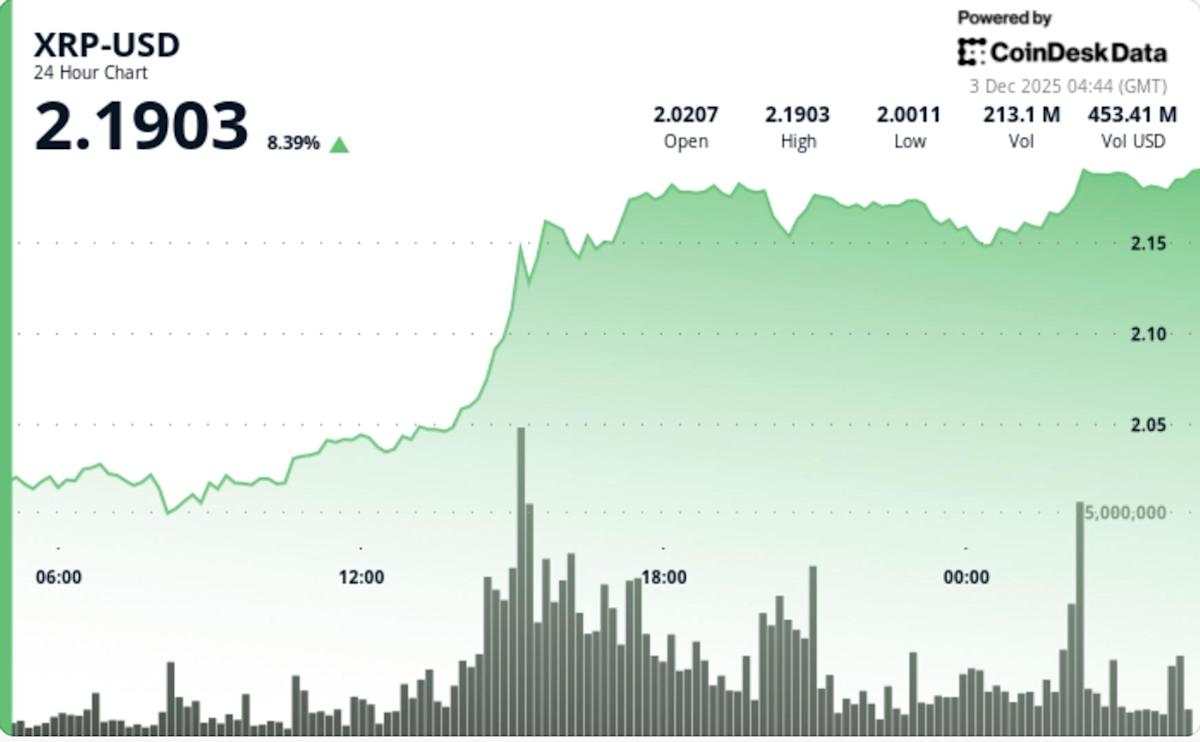

• XRP jumped from $2.03 to $2.17 as buyers overwhelmed sellers at key resistance levels

• Volume spiked 182% above average during the breakout window at 15:00 GMT

• XRP Ledger network activity surged to multi-year highs, with 40,000+ Account Set operations

• AMM-related positioning accelerated as regulatory clarity boosted developer and liquidity growth

• Institutional accumulation showed up in consecutive high-volume bursts above 1M units

XRP’s breakout above $2.10 confirms the completion of a multi-day compression structure that formed along the $2.00 support shelf. The surge in volume—more than doubling the 24-hour average—validates the move and indicates coordinated institutional participation rather than retail speculation.

The rally formed a clear ascending structure with consecutive higher lows at $2.00, $2.04, and $2.155. This upward curvature strengthens the ascending triangle that has been building for more than six months. XRP now approaches the structure’s upper boundary with a rising probability of continuation.

Momentum indicators are flipping bullish in ways not seen since major historical rallies. The weekly Stochastic RSI crossed upward from oversold territory—a pattern previously observed before XRP’s 600% 2024 breakout and its 130% mid-2025 rally. Combined with increasing network activity and record AMM engagement, the technical setup suggests expanding bullish pressure rather than a short-lived spike.

XRP traded within a $0.14 range, starting the session at $2.03 before surging to $2.17. The breakout occurred at 15:00 GMT during a 200.5M volume burst—by far the day’s heaviest activity. After clearing $2.10, the token printed new highs at $2.181 during the 02:12–02:13 window, supported by multiple 3M+ volume spikes. A consolidation band formed between $2.155 and $2.180 as late-session trading showed sustained accumulation rather than distribution.

• $2.17–$2.18 is now first resistance; clearing it opens the path to $2.33–$2.40

• $2.00–$1.98 remains the structural support zone and the invalidation level for the breakout

• Sustained volume above 1M per hour signals real accumulation and reduces odds of pullback traps

• Ascending triangle remains active with multi-month breakout implications

• Stochastic RSI bullish cross + surging network activity provides the strongest confluence since early-2024 rallies

Leave a Comment

Your email address will not be published. Required fields are marked *