China Ramps Up Iranian Oil Intake After Getting New Import Quota

(Bloomberg) — China’s independent oil refiners are boosting their intake of Iranian crude from onshore tanks and ships idling at sea after Beijing issued a fresh round of import quotas late last month.

Several processors based in Shandong province have been taking crude from bonded storage at ports and refineries this week, according to people familiar with the matter, asking to not be identified discussing sensitive information. A lot of the oil had been bought prior the new quota allocation, they said.

Most Read from Bloomberg

China’s private refiners, known as teapots, dominate the nation’s purchases of crude from Iran and Russia, which are cheaper than other grades, but had to scale back buying during the fourth quarter due to exhausted allocations and the fallout from sanctions. Beijing runs a quota system under which it controls the amount of oil that non state-owned refiners can import.

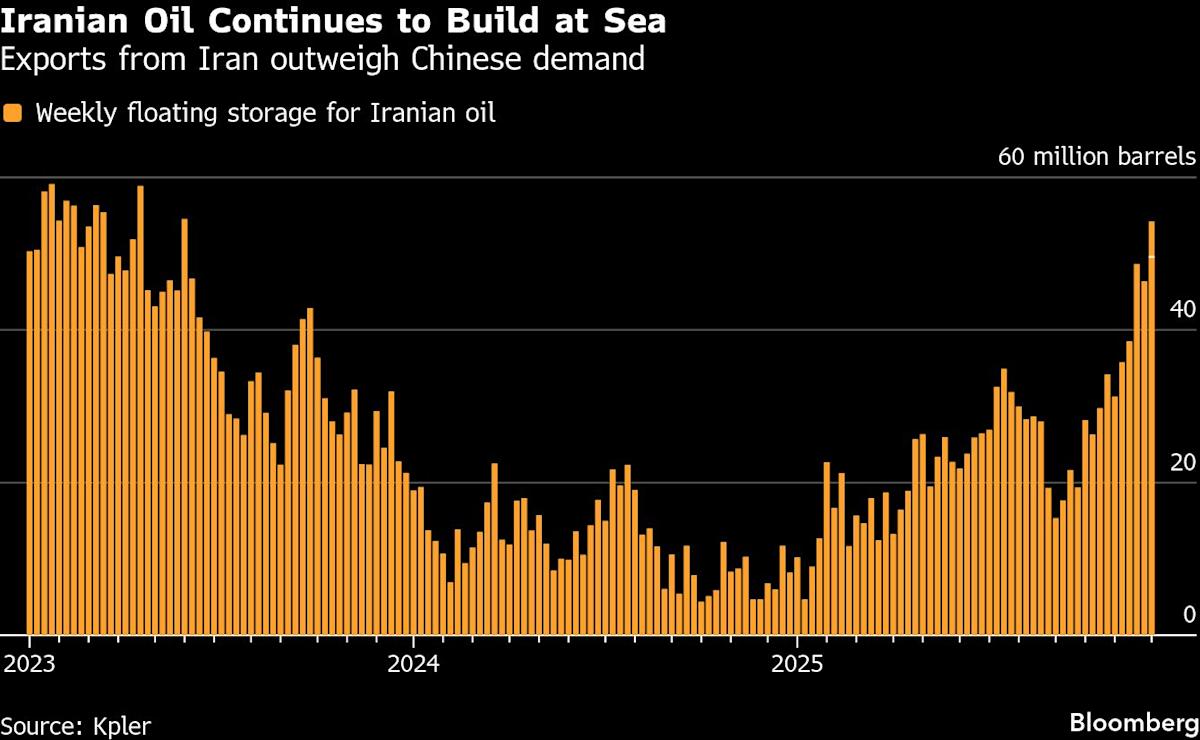

Still, overall demand from teapots is likely to remain muted through year-end, in part due to weak processing margins, according to Vortexa Ltd. That means “sanctioned crude is likely to keep accumulating on water,” said Emma Li, lead China market analyst for Vortexa.

Chinese authorities typically provide guidance on the overall annual quota, but don’t usually give details on the tranches issued throughout the year that make up the actual total figure. For the latest allocation, about 20 teapots got between seven-to-eight million tons, according to analysts.

Two supertankers carrying Iranian oil that had been idling off China, discharged their cargoes this week at separate Chinese ports, according to ship-tracking data compiled by Bloomberg. One of the vessels, Panama-flagged Ill Gap — transporting about 2 million barrels — unloaded at Rizhao.

The vessel’s Mumbai-based manager Eversail Ship Services OPC PVT, and owner Crystal Blue Sky Inc. that’s in the Marshall Islands, did not respond to emails for comment. It’s not been sanctioned by any Western governments.

Iranian crude held on tankers at sea climbed to more than 54 million barrels this week, the highest in about two and a half years, according to data from Kpler. China is the biggest consumer of oil from the OPEC producer, which is subject to sanctions. Exports recently rose to the fastest clip in years.

Given the very limited pool of buyers, Iranian oil needs to be cheap. Some cargoes of Iran Light were offered at a discount of around $8-to-$9 a barrel to ICE Brent this week, compared with about $4 in August, according to traders. Widening sanctions on Russia are also leading to cheaper barrels.

Leave a Comment

Your email address will not be published. Required fields are marked *