Australia Economic Growth Disappoints, Easing Rate-Hike Bets

(Bloomberg) — Australia’s economy grew at a surprisingly softer pace last quarter, clouding the picture on its underlying strength and suggesting markets may have been premature in pricing interest-rate hikes.

Gross domestic product advanced 0.4% in the three months through September, slower than the predicted 0.7%, government data showed Wednesday. The 2.1% annual expansion came in just below a forecast 2.2% gain, though it’s tracking close to the Reserve Bank’s estimates.

Most Read from Bloomberg

Government bond yields slipped after the data, erasing an earlier gain as traders trimmed bets on the Reserve Bank turning more hawkish next year. Stocks rose.

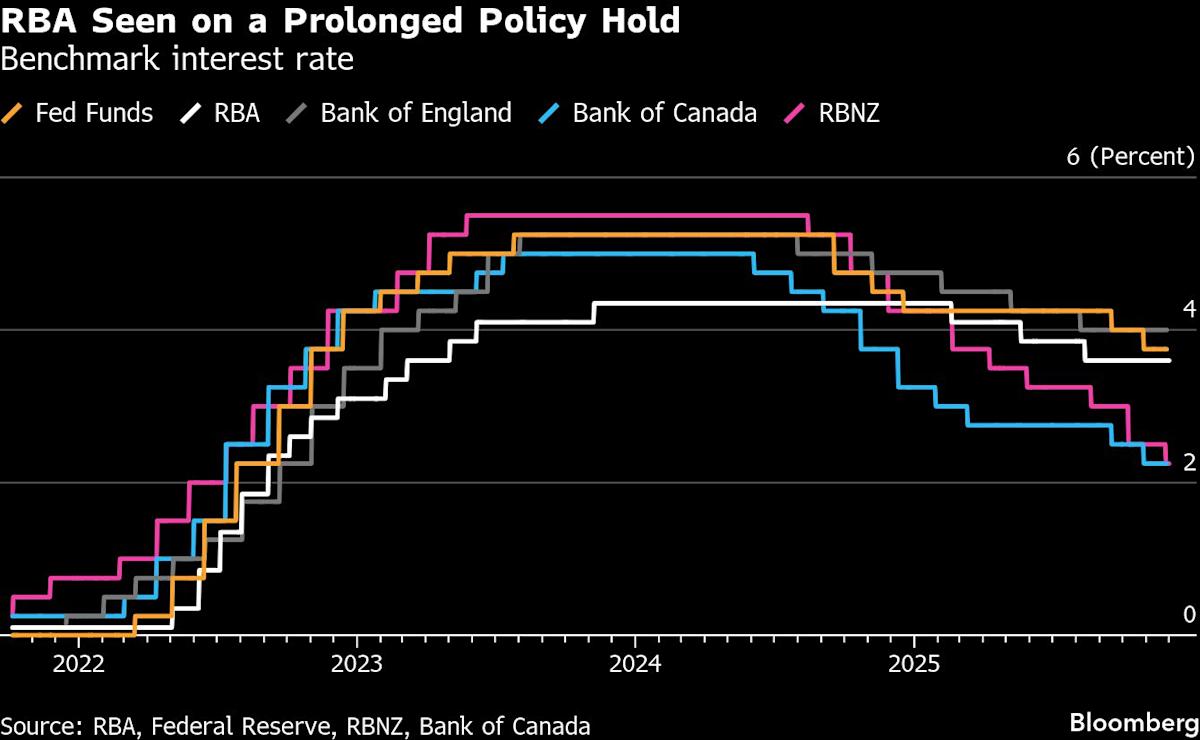

“The RBA will be on hold at 3.6% for the time being,” said Felix Ryan, a strategist at ANZ Group Holdings Ltd. “We think any market expectations, no matter how minor, of RBA rate hikes are a little unjustified at this stage.”

Australia’s bond market suffered its worst monthly selloff in more than a year in November, spurred by bets the RBA will hike next year amid inflation pressures and a still-healthy jobs market. The divergence in policy with the Federal Reserve has seen the yield premium Australian bonds hold over their Treasury counterparts rise to the most in more than three years.

The GDP data showed the household savings ratio climbed to 6.4% from 6% three months earlier, underpinned by higher incomes. Households also shifted away from discretionary spending, down 0.2%, while boosting essential outlays which jumped 1%.

Even so, Su-Lin Ong, chief economist at Royal Bank of Canada, reckons that details in the report pointed to underlying strength in the economy.

“The private side of the economy is continuing to pick up which is encouraging,” she said. “At a time when the labor market’s pretty healthy, the economy has limited capacity and inflation is already pushing at above target, that continued strength in unit labor costs suggest that the bank really has no scope to cut rates, that it needs to stay on the sidelines.”

And if inflation continues to surprise to the upside then there’s a risk that the next move in rates is up, Ong added.

That was also the assessment of RBA Governor Michele Bullock who warned earlier Wednesday that the rate-setting board would act on renewed price pressures. That had prompted traders to pull forward expectations for a hike to August, from November. However, those bets quickly unwound following the disappointing GDP report.

Leave a Comment

Your email address will not be published. Required fields are marked *