Chinese Manufacturing Is Slumping Despite Boost From Trade Truce

(Bloomberg) — China’s manufacturing activity contracted in November, according to official and private surveys, as stronger demand overseas after a trade truce with the US failed to reverse a deepening slowdown in the economy.

Despite a surge in new export orders, the RatingDog China manufacturing purchasing managers’ index unexpectedly slumped to 49.9, according to a statement released on Monday, falling below the 50 mark that separates growth and contraction for the first time in four months.

Most Read from Bloomberg

A day earlier, the National Bureau of Statistics said the official manufacturing PMI remained in contraction for an eighth month, improving slightly but extending its streak of declines to a record. Among the major components, the new export order sub-index rose the most.

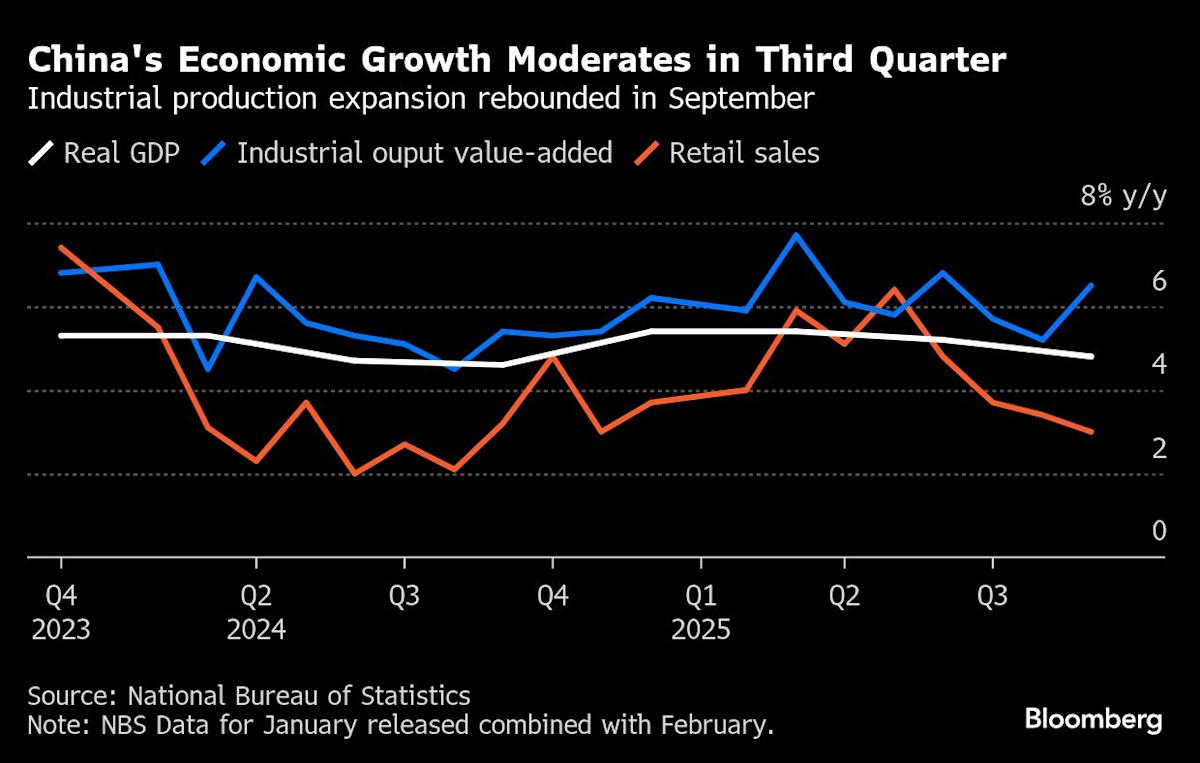

Offsetting the pull of improving sales abroad, stalling demand at home and distress in the housing market are pushing the economy toward its slowest expansion since the final three months of 2022, when the nation was nearing the end of its Covid Zero lockdowns. The non-manufacturing measure of activity in construction and services contracted in November for the first time in nearly three years, according to the NBS.

“Although new export orders picked up in November, this trend failed to reverse the sluggish state of the manufacturing sector,” Yao Yu, founder of RatingDog, said in the statement. “Considering the need to sprint toward the annual 5% growth target, there may be strengthened efforts on both the supply and demand sides at the end of the year.”

The PMI results marked a rare case of both the private and official surveys — which cover different sample sizes, locations and business types — simultaneously signaling a contraction in manufacturing. The private poll focuses on small and export-oriented firms, and its findings have tended to be more upbeat for much of this year.

The assessments add to a picture of an economy suffering a loss of momentum this quarter, with investment in an unprecedented decline and consumer demand still sluggish. But tensions with the US have eased after a temporary truce reached weeks ago following a meeting in South Korea between Presidents Donald Trump and Xi Jinping.

China’s annual growth target of around 5% is within reach, especially after the government already injected additional stimulus worth 1 trillion yuan ($141 billion) since late September.

When the standoff with the Trump administration escalated in October, Chinese exports unexpectedly contracted as global demand failed to offset the slump in shipments to the US. Chinese industrial enterprises saw their earnings drop in October for the first time in three months.

Leave a Comment

Your email address will not be published. Required fields are marked *