Nvidia stock slides after Q3 earnings, forecasts top estimates with sales for AI chips ‘off the charts’

Nvidia (NVDA) stock fell along with the broader market on Thursday, despite the chipmaker posting better than expected third quarter earnings and providing a strong outlook for the current quarter a day earlier.

Shares of Nvidia closed out the trading day down 3.15%, after briefly turning higher at the start of the day. The company’s Magnificent 7 compatriots also fell on the day.

For the fourth quarter, Nvidia projects revenue of $65 billion plus or minus 2%. Wall Street was expecting revenue of $62 billion.

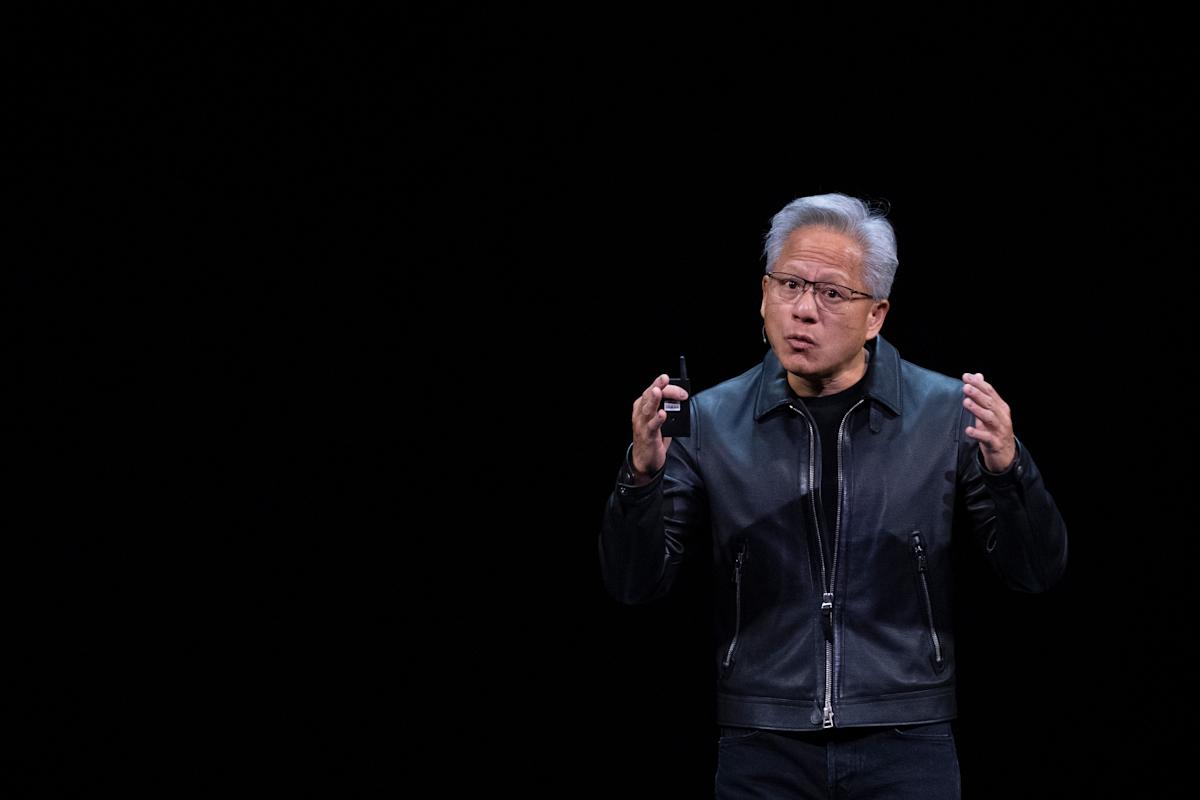

“Blackwell sales are off the charts, and cloud GPUs are sold out,” CEO Jensen Huang said in a statement.

“We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling fast — with more new foundation model makers, more AI startups, across more industries, and in more countries. AI is going everywhere, doing everything, all at once,” he added.

For Q3, Nvidia saw earnings per share (EPS) of $1.30 on revenue of $57.01 billion. Analysts were anticipating EPS of $1.26 on revenue of $55.2 billion, according to Bloomberg consensus data. The company saw EPS and revenue of $0.81 and $35.1 billion, respectively, in the same period last year.

The AI giant’s data center business brought in $51.2 billion versus estimates of $49.3 billion. Nvidia’s gaming revenue was $4.3 billion, just short of the $4.4 billion estimate.

“Blackwell Ultra is now our leading architecture across all customer categories while our prior Blackwell architecture saw continued strong demand,” CFO Colette Kress said in a statement.

Revenue from its China-specific H20 chip was “insignificant,” she added.

Nvidia’s report comes after the company’s market capitalization briefly eclipsed $5 trillion last month.

Ahead of the earnings announcement, Peter Thiel’s hedge fund sold off its entire roughly $100 million stake in Nvidia. SoftBank Group (SFTBY) also unloaded all of its Nvidia stock, valued at $5.8 billion, as the company seeks to fund its own enormous AI bets.

It also follows remarks from rival Advanced Micro Devices CEO Lisa Su during the company’s Financial Analyst Day, during which she said that she believes the data center market will be worth as much as $1 trillion by 2030.

Read more: Live coverage of corporate earnings

Nvidia stock is up more than 37% year to date and 25% over the last 12 months. Shares of AMD are up 82% year-to-date and 58% over the last 12 months.

Despite those gains, the AI trade gained a major detractor last week in investor Michael Burry, who famously shorted the housing market ahead of the 2008 financial crisis. In a post on X, Burry claimed that companies, including Meta (META) and Oracle (ORCL), are artificially boosting their earnings results by understating the depreciation of data center equipment.

Leave a Comment

Your email address will not be published. Required fields are marked *