ANZ CEO says bank needs cultural change to fix ongoing mistakes

By Scott Murdoch

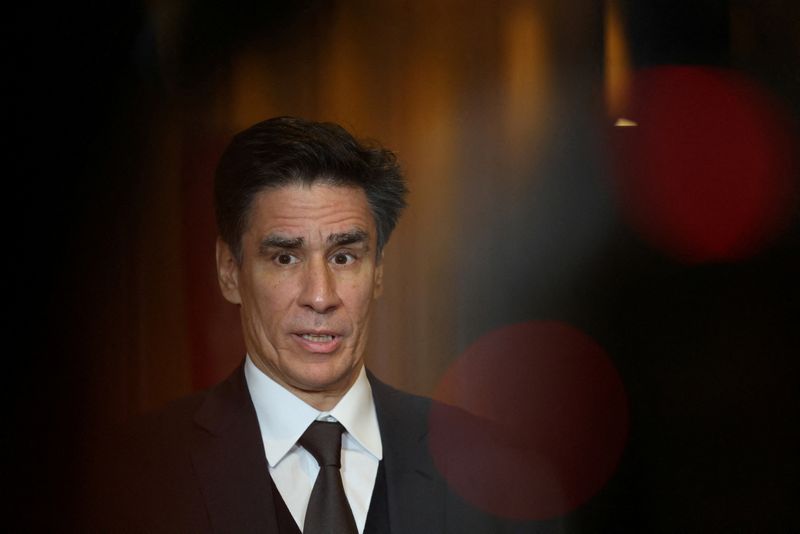

SYDNEY (Reuters) -ANZ Group CEO Nuno Matos on Wednesday told lawmakers the embattled lender needed a cultural overhaul and to be accountable for its mistakes, as the bank faces ongoing pressure from Australian regulators.

Matos said ANZ was too complex and had too much duplication, which he was determined to simplify as part of his future strategy.

The Australian Securities and Investments Commission (ASIC) has brought 11 civil penalty proceedings against ANZ since 2016, with total penalties exceeding A$310 million ($201.69 million), for cases ranging from market misconduct on a government bond deal in 2023 to charging fees to dead customers.

The bank was found to have a “good news culture” that deterred staff from speaking up about potential mistakes, according to a report from McKinsey that was published by ANZ last week as part of a remediation process ordered by Australian regulators.

“We need to be more self-aware of things we don’t do well, we need to execute on time and be accountable,” Matos told a regular parliamentary hearing on the country’s biggest banks in Canberra on Wednesday.

“That’s the culture we are creating every single day at ANZ. Now culture takes years to transform, and if I say to you that after six months culture is different I would be naive…It will take some time.”

Matos, a former senior HSBC executive, became ANZ’s chief executive in May, replacing long-serving former boss Shayne Elliott.

Matos told the parliamentary hearing a number of senior ANZ executives had left the bank since he joined, as he refreshed its leadership bench. The lender has also announced plans to cut 3,500 jobs across its workforce.

ANZ accepted a A$240 million penalty in September from ASIC over the bond deal and other cases of wrongdoing. It was the largest-ever single-entity penalty sought by the corporate regulator.

($1 = 1.5370 Australian dollars)

(Reporting by Scott Murdoch; Editing by Jamie Freed)

Leave a Comment

Your email address will not be published. Required fields are marked *