Fed researchers say tariffs actually lower inflation — because they’re a demand shock that slams employment and economic activity

A new study that examined 150 years of tariffs in the U.S. and abroad found they disrupt the economy and financial markets so much that the result is lower inflation.

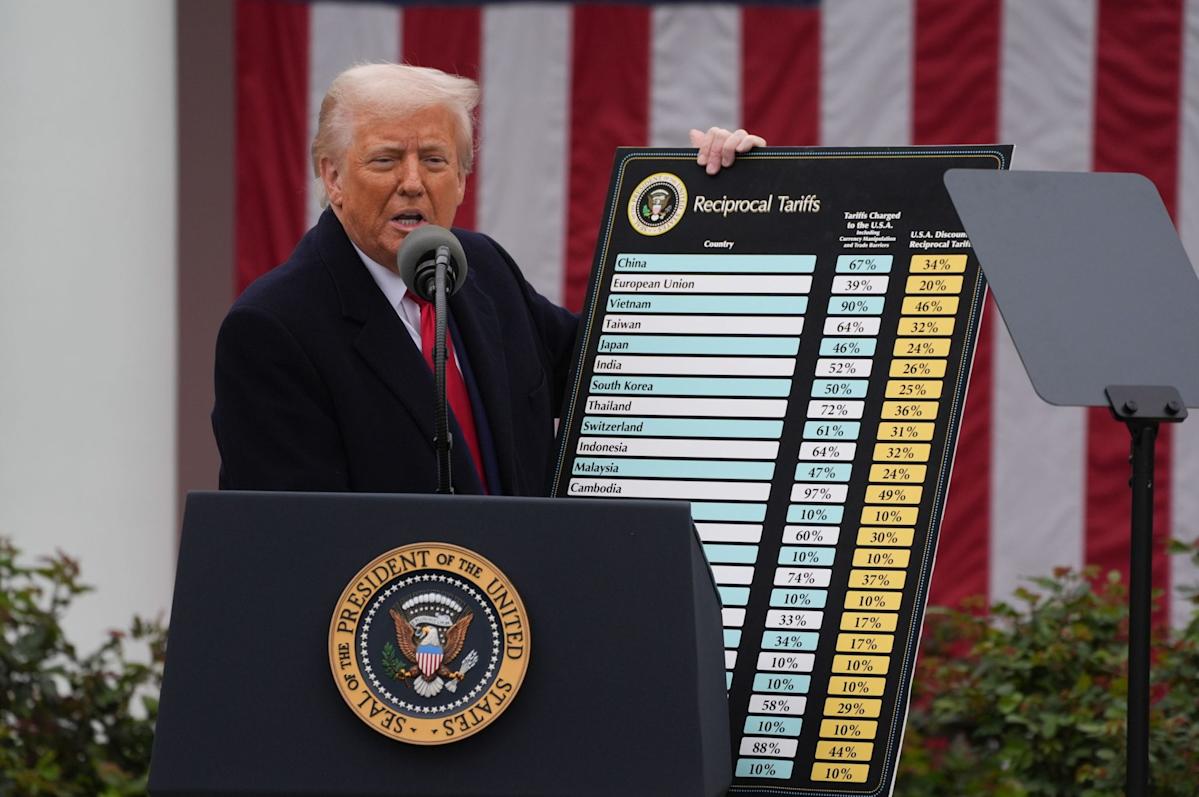

The conclusion goes against the conventional wisdom on how import taxes affect prices and comes as President Donald Trump’s tariffs have stirred a growing backlash among Americans who are angry about higher food, utility and insurance costs.

But if the study’s finding are correct, Trump may eventually be able to point to better inflation numbers, assuming he can stomach a weaker economy and labor market.

In a working paper published on Thursday, San Francisco Fed researchers Régis Barnichon and Aayush Singh said higher tariffs lead to reduced economic activity, higher unemployment and lower inflation in the short term.

“The inflation response goes against the predictions of standard models, whereby CPI inflation should go up in response to higher tariffs,” they wrote. “Instead, tariff shocks appear to act as aggregate demand shocks—moving inflation and unemployment in the same directions.”

One possible explanation is that tariffs create uncertainty that hits consumers’ and investors’ confidence, depressing economic activity and putting downward pressure on inflation, according to the study.

Alternatively, tariffs could trigger a drop in asset prices that also weigh on demand, resulting in higher unemployment and lower inflation.

“We find evidence in support of both channels: in response to higher tariffs, stock prices decline and stock market volatility increases,” Barnichon and Singh wrote.

Before World War II, they found that a permanent 4-percentage-point increase in the tariff rate reduced inflation by 2 percentage points and raised unemployment by about 1 percentage point.

After the war, the estimates are more uncertain but still point to tariff hikes reducing inflation and worsening unemployment, they added.

Administration officials have long maintained that Trump’s tariffs aren’t stoking inflation, even though the consumer price index has crept higher since he launched his trade war in April.

But on Friday, Trump announced that he’s scrapping tariffs on beef, coffee, and a range of other commodities, after voter anger about worsening affordability delivered stunning losses to Republicans during off-year elections this month.

Meanwhile, Federal Reserve Chairman Jerome Powell and other policymakers believe tariffs will likely produce a one-time boost to inflation, which eventually will resume its cooling trajectory.

Leave a Comment

Your email address will not be published. Required fields are marked *