By Howard Schneider and Ann Saphir

WASHINGTON (Reuters) -Federal Reserve officials on Monday continued pressing competing views of where the economy stands and the risks facing it, a debate set to intensify ahead of the U.S. central bank’s next policy meeting and in the absence of data suspended due to the federal government shutdown.

In her first public remarks since President Donald Trump launched a so-far unsuccessful attempt to remove her from her position, Fed Governor Lisa Cook portrayed a tug-of-war view of the policy debate, saying elevated risks to both the central bank’s employment and inflation mandates leave the December 9-10 meeting “live” for a possible rate cut, but not a lock.

“Keeping rates too high increases the likelihood that the labor market will deteriorate sharply,” though for now the labor market is “still solid,” she said during an event at the Brookings Institution.

On the other hand, Cook said, “lowering rates too much would increase the likelihood that inflation expectations will become unanchored,” though at this juncture “it is encouraging that most long-run inflation expectations … are low and stable.”

“The dual mandate is in tension … so I’m attentive to both sets of risks and I will keep monitoring the labor market data we have, the inflation data we have,” said Cook, who is embroiled in a legal battle with Trump over his effort to remove her as a Fed governor. The U.S. Supreme Court is due to hear arguments in the case early next year.

SHARP SPLIT WITHIN FED

Remarks from three of Cook’s fellow policymakers earlier on Monday, and from five others on Friday, highlight the split among Fed officials that emerged from a 10-2 policy vote at the central bank’s October 28-29 meeting to lower the benchmark interest rate by a quarter of a percentage point to the 3.75%-4.00% range.

It was only the third time since 1990 that dissents were cast in favor of both tighter and looser monetary policy at the same meeting. Fed Chair Jerome Powell, speaking at a press conference on Wednesday, indicated an even deeper divide as he noted the “strongly differing views about how to proceed” at the December 9-10 meeting and said another rate cut then “is not a foregone conclusion – far from it.”

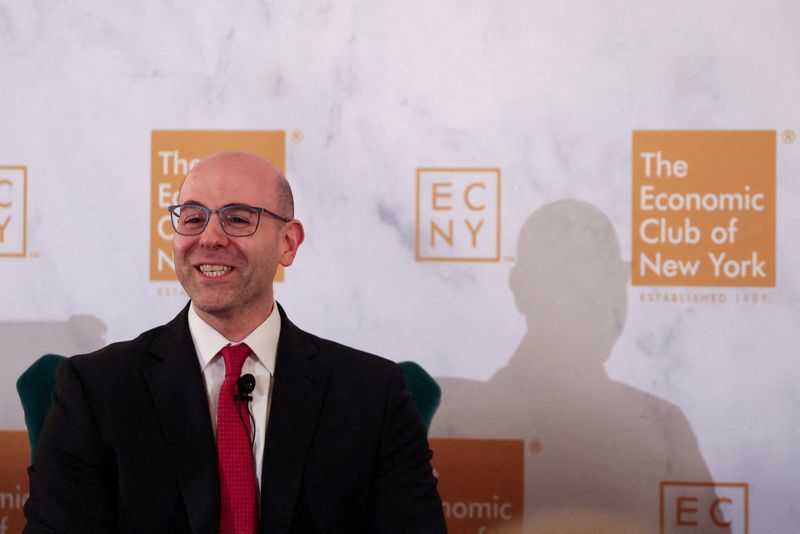

In an appearance on the Bloomberg Surveillance television program, Fed Governor Stephen Miran restated the case for deep interest rate cuts that he has laid out since joining the central bank’s Board of Governors in September, and expanded his rationale to argue that buoyant stock and corporate credit markets are no reason to think monetary policy is too loose.

“Financial markets are driven by a lot of things, not just monetary policy,” said Miran, who is on leave from his job as a top economic adviser in the White House, in explaining why he dissented last week against the Fed’s decision to cut rates by a quarter of a percentage point. Miran favored a half-percentage-point reduction.

Rising equity prices, narrow corporate credit spreads, and other factors don’t “necessarily tell you anything about the stance of monetary policy” at a moment when interest-sensitive sectors like housing are less buoyant and some parts of the private credit market appear under stress, Miran said, adding that he is more sanguine than his colleagues about inflation, and feels that by keeping policy too restrictive the Fed is heightening the risk of a downturn.

Chicago Fed President Austan Goolsbee, in contrast, told Yahoo Finance he was leery of further rate cuts while inflation remains significantly above the central bank’s 2% target and is expected to accelerate through the rest of 2025.

Goolsbee, who is a voting member of the Fed’s policy committee this year, supported the recent rate cut, but said “I’m not decided going into the December meeting … I am nervous about the inflation side of the ledger, where you’ve seen inflation above the target for four and a half years, and it’s trending the wrong way.”

San Francisco Fed chief Mary Daly, whose turn to vote isn’t until 2027 but who takes part in the policy discussion and debate as all 19 U.S. central bankers do, also said she supported last week’s cut as “insurance” against labor market weakening.

As for the December meeting, Daly said she has an “open mind” and feels the Fed could cut again “if we feel that more is needed because we’re getting more signs” that there is a “precipice of concern” about the labor market. “I don’t see that right now,” she said, noting that inflation remains too high and the Fed must make a decision that “balances those risks.”

SCHMID LAYS OUT CASE FOR KEEPING MORE FOCUS ON INFLATION

Kansas City Fed President Jeffrey Schmid, who dissented in favor of no rate cut last week, laid out on Friday the case for keeping more of a focus on inflation, and noted that high equity prices and elevated high-yield bond issuance do not suggest that “financial conditions are particularly tight or that the stance of policy is restrictive.”

Asked specifically about the arguments cited by Schmid, a career banker, Miran said they overlooked stress that may be developing elsewhere in the financial system and the sluggishness in the housing market.

Miran also noted that the economy has been buffeted by population changes and other shocks since last year that have lowered underlying interest rates and mean “that policy has passively tightened” despite the Fed’s rate cuts. He said he continues to think the central bank should cut rates in half-percentage-point increments until hitting a “neutral” level he estimates is “quite a ways below” where it is now.

Miran’s preference for steep rate cuts remains an outlier, though others at the central bank, including Fed Governor Christopher Waller, have similarly indicated they feel short-term borrowing costs are restraining the economy, which allows room for further rate cuts.

That view remains contested.

“I think we’re barely restrictive, if at all,” Cleveland Fed President Beth Hammack said on Friday.

(Reporting by Howard Schneider; Additional reporting by Michael Derby and Ann Saphir; Editing by Andrea Ricci and Paul Simao)

Leave a Comment

Your email address will not be published. Required fields are marked *