Gold Rally Stalls Near Record as US Data Clouds Rate-Cut Outlook

(Bloomberg) — Gold held a decline — but remained near an all-time high — as traders weighed positive US economic data and divergent views by Federal Reserve officials this week that clouded the path for interest-rate cuts.

Bullion edged up to near $3,745 an ounce — less than $50 shy of a record set on Tuesday. Prices fell on Wednesday after data showed new-home sales in the US unexpectedly surged in August to the fastest pace since early 2022, easing some concerns about a slowdown in the world’s biggest economy. The dollar rose to the highest in almost two weeks, making gold more expensive for most buyers.

Invest in Gold

Most Read from Bloomberg

Investors were also digesting comments from US officials, with Treasury Secretary Scott Bessent on Wednesday expressing disappointment that Fed Chair Jerome Powell hasn’t clearly established an agenda for cutting rates. Earlier this week, the head of the US central bank reiterated the need to take a cautious approach amid signs of a weakening labor market and the risk of higher inflation. Lower rates tend to benefit precious metals, which don’t pay interest.

Gold and silver have been among this year’s best-performing major commodities on a broad confluence of supportive factors, including last week’s Fed rate cut, as well as robust central-bank demand. On Tuesday, prices climbed as much as 1.2% to a peak at $3,791.10 an ounce, after Bloomberg News reported China has plans to become a custodian of foreign sovereign bullion reserves.

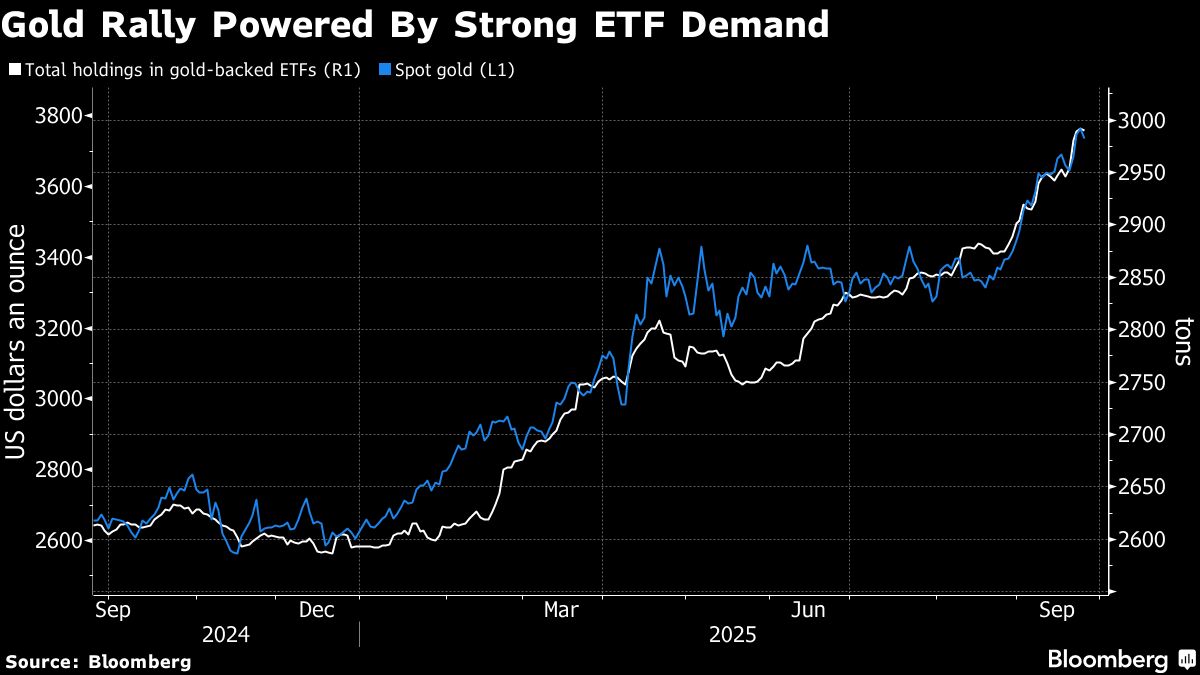

Bullion has also seen strong demand from exchange-traded funds, with inflows hitting a three-year high on Friday. So far this year, bullion-backed holdings have risen every month apart from May, expanding by 400 tons, according to data compiled by Bloomberg.

Looking ahead, traders will focus on the US personal consumption expenditures price index that’s due on Friday. The Fed’s preferred measure of underlying inflation likely grew at a slower pace last month, which would boost the argument for rate cuts.

Spot gold edged up 0.2% to $3,743.09 an ounce at 7:50 a.m. in Singapore, after falling 0.7% on Wednesday. The Bloomberg Dollar Spot Index was down 0.1%, following a 0.6% gain in the previous session. Silver and platinum were little changed, while palladium rose.

Leave a Comment

Your email address will not be published. Required fields are marked *