The world’s biggest company just told everyone to chill out

Concerns about an AI bubble have been simmering for at least a year and a half. Nvidia’s incredibly strong earnings this past week tried to put those fears to bed. It may not have been enough.

Nvidia on Wednesday posted sales and profits up more than 60% year-on-year, stronger than Wall Street had projected. CEO Jensen Huang said “sales are off the charts.” And the company expects fourth quarter revenue of around $65 billion, once again ahead of Wall Street’s projections.

Nvidia executives said these results, along with growth from other major AI players and the billions being poured into AI infrastructure, indicate that fears of an AI bubble are overblown.

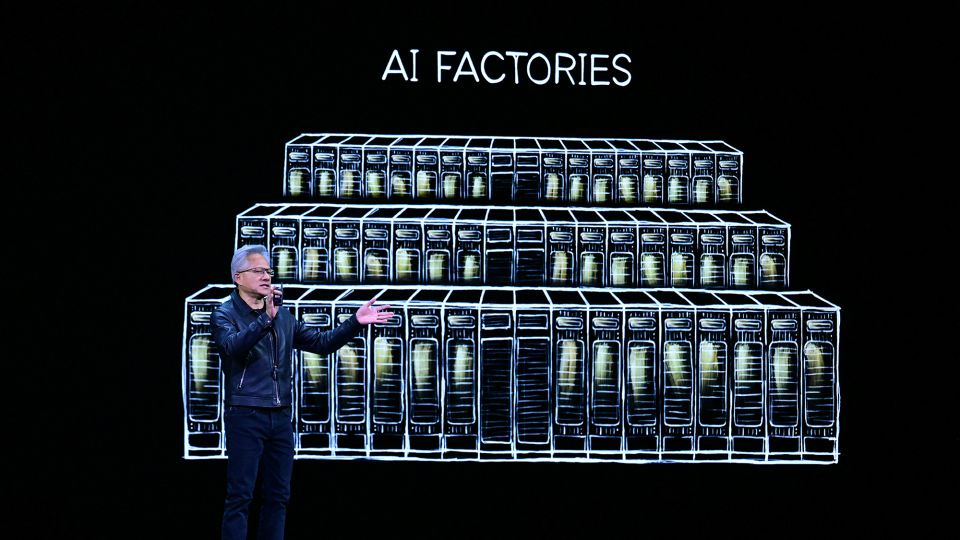

“There’s been a lot of talk about an AI bubble,” Huang said on a call with analysts Wednesday. “From our vantage point, we see something very different.”

Some Wall Street analysts agree. But the wider market is not yet convinced: After briefly ticking up on Thursday morning following Nvidia’s report, the chipmaker’s shares (NVDA) dipped back into the red. They closed Friday down 1%, although the stock remains up 29% from the start of this year.

In other words, Nvidia answered a lot of questions about where the industry stands right now, but it may take more to shift the overall AI narrative.

Nvidia CFO Colette Kress said the company anticipates $3 trillion to $4 trillion in annual AI infrastructure spending by the end of the decade, adding that demand “continues to exceed our expectations.” Already, tech giants are expected to pour $400 billion into AI-related capital expenditures this year, to meet what they say is growing demand for AI and cloud services but also to avoid falling behind industry rivals.

Nvidia has every reason to try to reassure investors — expectations for the company are sky-high after nearly two years of astronomical growth. And many look to the chipmaker as a bellwether for the overall tech industry.

Even as Silicon Valley tries to figure out the business model for generative AI, Nvidia has a big role to fill in the existing tech services people use every day, Huang said. That could help insulate Nvidia even if returns from new AI applications are smaller than expected or take longer to arrive than planned.

“The world has a massive investment in non-AI software, from data processing to science and engineering simulations, representing hundreds of billions of dollars in cloud computing spend each year.” Much of the infrastructure powering that software has transitioned from running on older CPU chips to Nvidia’s GPUs, the chips known for running AI tools, Huang said.

Leave a Comment

Your email address will not be published. Required fields are marked *