Wall Street doesn’t agree with Main Street about Nvidia

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

Reports of the death of the AI trade were greatly exaggerated, Nvidia (NVDA) and its bullish analysts want you to know.

Instead of showing AI growth flatlining, Wall Street saw the company deliver AI-infused vindication.

Investors on Thursday appeared to agree before igniting a sell-off that led to a 3% drop for Nvidia and 1.6% for the S&P 500 (^GSPC). But for now, Wall Street and the rest of the market will have to agree to disagree, because the vibes in analyst commentary and those red numbers simply do not match.

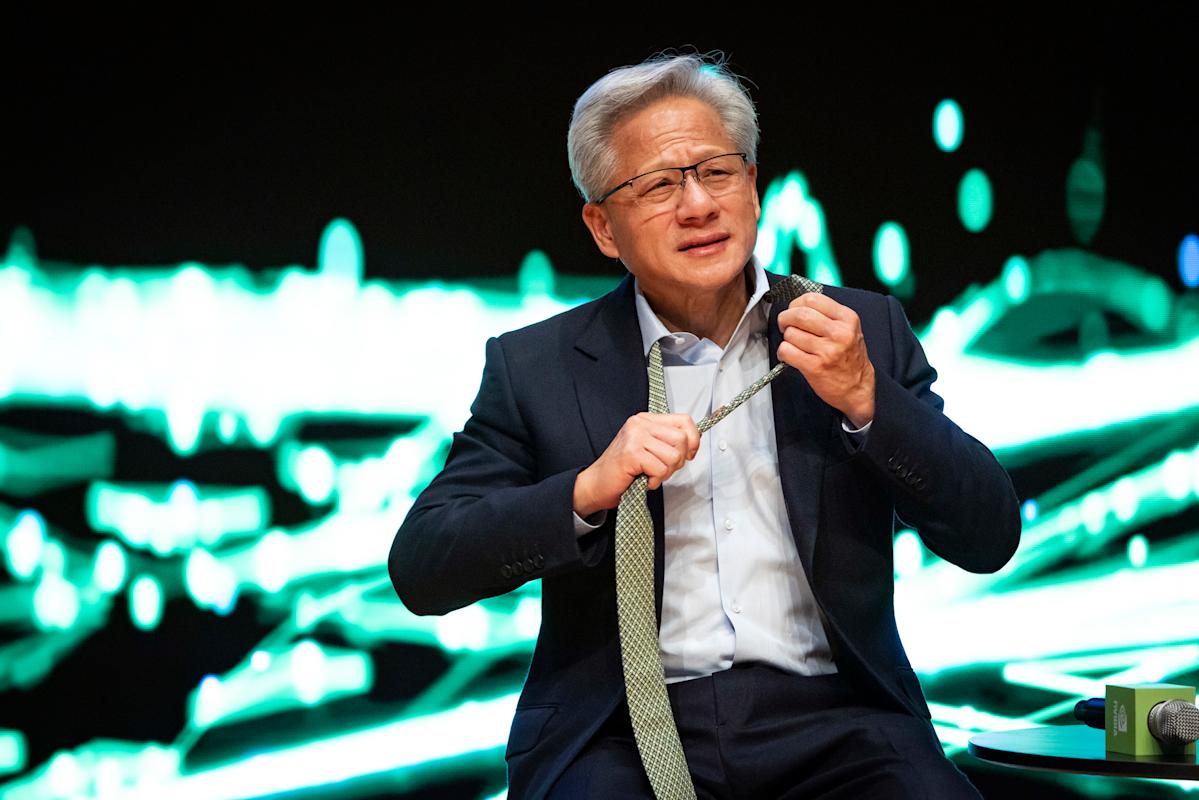

Similar to the newly released jobs numbers that, in at least the hiring dimension, surprised markets, Nvidia bulls seized on the company’s earnings beat and CEO Jensen Huang’s triumphant commentary as a definitive marker of the direction the AI trade is headed. That is, the one with more money.

“Nvidia answered the ‘AI Bubble’ question loud and clear with a drop the mic quarter,” said analyst Dan Ives in a note Thursday.

While Huang addressed the criticisms of an AI bubble head-on, perhaps with the appropriate level of confidence after a stellar quarter, it’s worth revisiting the bumpy road that led to this moment. As Ives summarized months of drama, from the shake-up triggered by DeepSeek and US-China trade worries to tariffs and questions over the sustainability of Big Tech’s massive capex, tech bulls have had to navigate through waves of naysaying.

This, as he puts it, was the earnings call that tech bulls “needed to hear.”

“Nvidia’s breakout earnings reminded investors where the strength still lies,” said Gina Bolvin, president of Bolvin Wealth Management Group, in a note on Thursday.

Huang and his lieutenants delivered a full-throated message that the market is too concerned with bubble talk and not enough with Nvidia’s own vision of investment and industry demand.

As UBS analyst Timothy Arcuri said in a note after earnings, “Ultimately, the AI infrastructure tide is still rising so fast that all boats will be lifted, but NVDA seems to be actually tightening its grip on broadly enabling AI across modalities (text, video, etc.) and industries.”

Yes, Wall Street thinks the quarter should calm AI jitters and give backers more reasons to cling to the stock. But even analysts who reiterated their Buy ratings can still see the risks that Nvidia’s critics are focusing on. Risks that ultimately turned a big day in green into a big day in red on Thursday.

Leave a Comment

Your email address will not be published. Required fields are marked *