‘We see something very different’

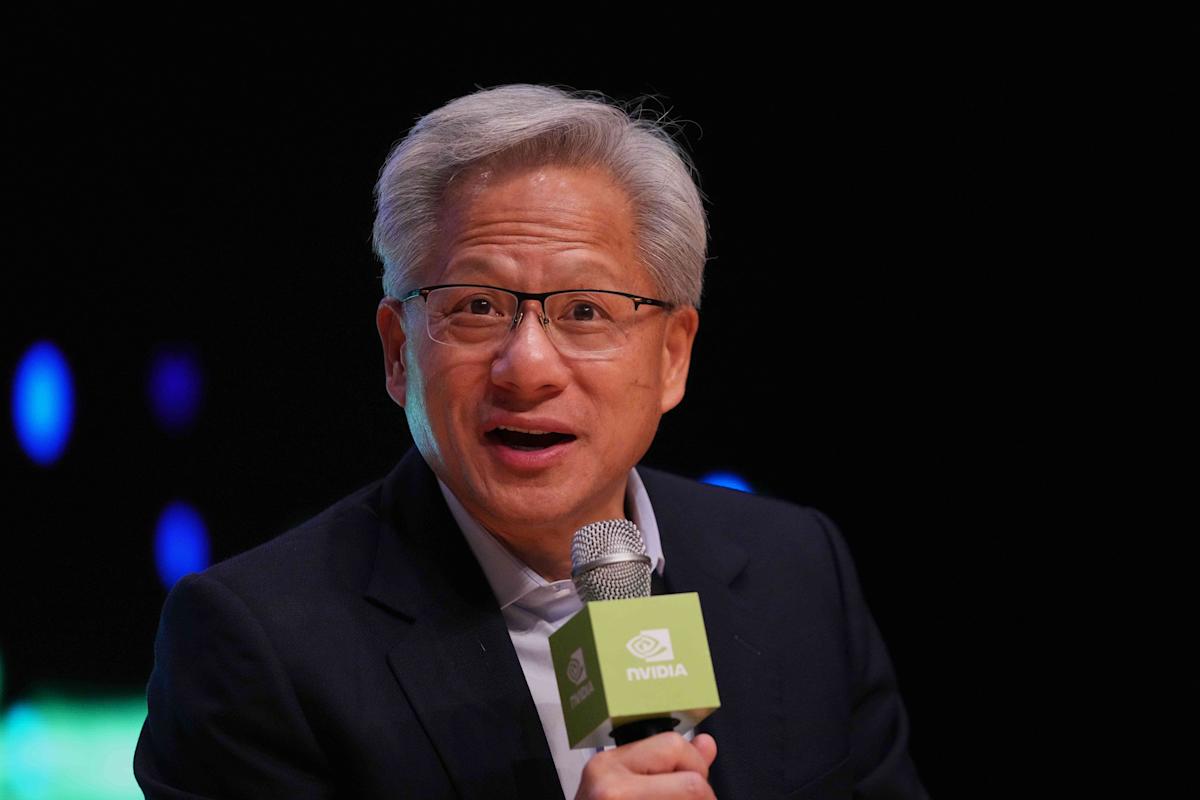

Nvidia (NVDA) took its detractors to task during the company’s Q3 earnings call on Wednesday, with both CEO Jensen Huang and CFO Colette Kress launching broadsides against investor concerns related to an AI bubble.

Huang didn’t dance around the topic, immediately addressing it in his prepared statement and laying out why he believes Nvidia is uniquely positioned to continue leading the AI market.

“There’s been a lot of talk about an AI bubble,” Huang began his remarks. “From our vantage point, we see something very different. As a reminder, Nvidia is unlike any other accelerator. We excel at every phase of AI.”

It didn’t hurt the CEO’s argument that Nvidia beat Wall Street’s expectations on both the top and bottom lines for the prior quarter and issued better-than-anticipated guidance for the current fourth quarter.

In Q3, the company saw earnings per share (EPS) of $1.30 on revenue of $57.01 billion. Analysts were estimating EPS of $1.26 on revenue of $55.2 billion, according to Bloomberg consensus data.

For the fourth quarter, the company said it will bring in revenue of $64 billion-plus or minus 2%, better than Wall Street’s projected $62 billion.

What’s more, during Nvidia’s earnings call, CFO Colette Kress told investors and analysts the company has visibility toward $500 billion in Blackwell and Rubin AI chip revenue through calendar 2026. The company is currently in fiscal 2026.

Nvidia stock rose more than 4% in early trading Thursday, before turning negative along with the broader market.

Huang also pushed back against questions regarding Nvidia and the broader AI industry’s circular investments. Those include deals like Nvidia and Microsoft’s (MSFT) arrangement with Anthropic (ANTH.PVT), which will see the Claude developer purchase $30 billion worth of Microsoft’s Azure cloud usage. In turn, Nvidia and Microsoft agreed to invest $10 billion and $5 billion, respectively, into Anthropic.

Nvidia has been central to several of these types of deals, which include similar arrangements with OpenAI (OPAI.PVT), CoreWeave (CRWV), and numerous other companies.

That has led investors to sound alarm bells about the potential for such agreements to create artificial demand for GPUs, further inflaming fears of an AI bubble.

Huang, however, said Nvidia’s pacts to provide funding to companies that then purchase Nvidia chips are part of the chip giant’s effort to expand the reach of its CUDA ecosystem.

CUDA is the software that allows Nvidia GPUs to power AI apps and be used for general-purpose computing. This includes a range of add-on capabilities for various use cases, from robotics to 3D simulation.

Leave a Comment

Your email address will not be published. Required fields are marked *