-

Wall Street says Nvidia’s blowout quarter shows the AI boom is far from peaking.

-

Nvidia posted $57 billion in revenue on Wednesday, topping analysts’ $55 billion estimates.

-

“Fears of an AI bubble are way overstated,” one analyst said.

Nvidia’s blockbuster earnings just blew a hole through Wall Street’s AI bubble anxieties.

Analysts said the chipmaker’s third-quarter results prove the AI boom is nowhere near running out of steam.

On Wednesday, Nvidia posted $57 billion in revenue, topping Wall Street’s $55 billion estimates. Its data center division generated revenue of $51 billion, surpassing the $49.31 billion analysts had projected. The company reported earnings of $1.30 per share compared to the $1.26 estimate. It also forecast $65 billion in revenue for the fourth quarter, exceeding analysts’ expectations of $61.98 billion.

Nvidia’s stock rose about 3% in after-hours trading following the results and climbed about 4.5% after hours as the analyst call wrapped.

“Fears of an AI bubble are way overstated,” Dan Ives, managing director and senior equity research analyst at Wedbush Securities, wrote after the print. The tech bull called the results a “pop-the-champagne moment” for tech investors.

“This is another validation point for the AI revolution,” Ives wrote. “We are in the top of the third inning of this AI game.”

Other analysts echoed that view. Thomas Monteiro, a senior analyst at Investing.com, said Nvidia’s report shows the AI revolution is “nowhere near its peak,” with both demand and supply chain scaling continuing.

Despite concerns that ballooning capital expenditures — estimated at more than $400 billion across top cloud platforms — could lead to a slowdown, Monteiro said Nvidia’s numbers show that tech companies remain committed to scaling their data centers.

Daniel Morgan, a senior portfolio manager at Synovus Trust, said investors remain wary of what he calls the “three C’s” — capex sustainability, circular financing, and rising competition.

“While these issues were not put to rest, the recent print does give investors confidence that Nvidia is still executing at a high level,” he wrote. Nvidia’s results suggest those fears can at least be “punted” into the next quarter, he added.

EMARKETER tech analyst Jacob Bourne told Business Insider that while Nvidia “delivered another blockbuster quarter,” investors are increasingly focused on whether physical constraints — including power availability, land, and grid access — may limit how quickly hyperscalers can turn GPU capacity into actual revenue.

During the earnings call, Nvidia reiterated that it has “half a trillion” in Blackwell and Rubin chip revenue through 2026.

Things are “on track” and “the number will grow,” Colette Kress, the chief financial officer, said.

“We’ll probably be taking more orders,” she said, noting that new customers — including Anthropic following its recent deal — would add demand. “There’s definitely an opportunity for us to have more on top of the $500 billion that we announced,” she added.

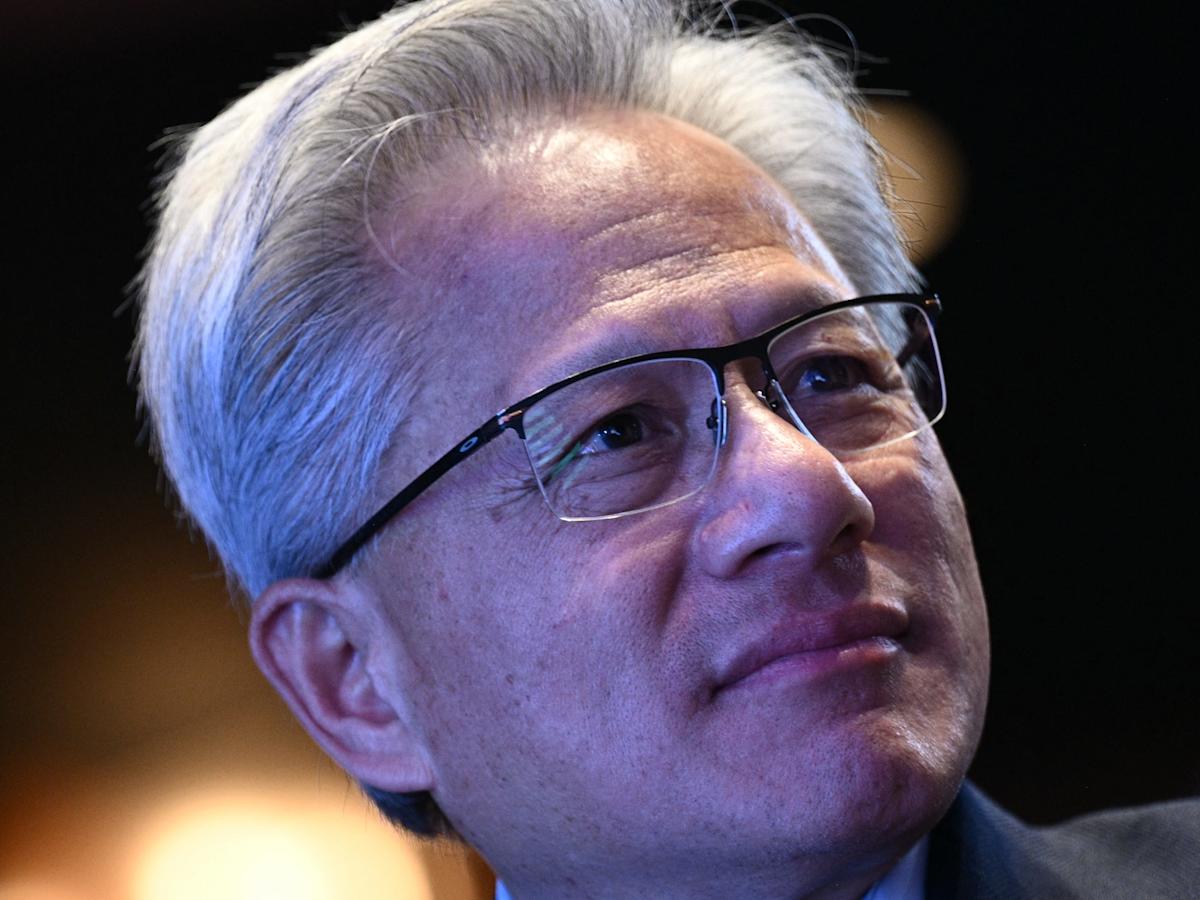

Huang drew attention at Nvidia’s October GTC conference after revealing that the company has $500 billion worth of AI-chip orders booked for 2025 and 2026, including orders for its Blackwell and Rubin chips.

“Blackwell sales are off the charts, and cloud GPUs are sold out,” Jensen Huang said in Nvidia’s earnings release.

Jefferies’ analysts said that Nvidia’s Blackwell GB300 GPU sales, which accounted for two-thirds of Blackwell sales, were “very strong.”

“Nvidia answered the bell with GB300 shipments driving healthy upside to estimates,” they wrote. They said that Nvidia’s results “should help steady the ship” for AI stocks into the end of the year.

“Commentary around cloud service providers being sold out across the board and full utilization for Blackwell, Hopper, and even Ampere should help put the useful life conversation to bed,” the analysts added.

The Nvidia CEO kicked off his remarks on Wednesday by taking aim at the “AI bubble” chatter.

“There’s been a lot of talk about an AI bubble,” said Huang, who is a longtime AI bull. “From our vantage point, we see something very different. As a reminder, Nvidia is unlike any other accelerator. We excel at every phase of AI, from pre-training and post-training to inference.”

Some tech leaders have been warning that AI may be in bubble territory.

Microsoft cofounder Bill Gates said in October that the market could be in the middle of an AI bubble.

“The value is extremely high, just like creating the internet ended up being, in net, very valuable,” Gates said in an appearance on CNBC’s “Squawk Box”. “But you have a frenzy. And some of these companies will be glad they spent all this money. Some of them, you know, they’ll commit to data centers whose electricity is too expensive.”

“There are a ton of these investments that will be dead ends,” he added.

Others, like Huang, have pushed back on the AI bubble narrative.

Former Google CEO Eric Schmidt said in July that the AI frenzy may resemble a bubble, but that doesn’t mean it is one in reality.

“I think it’s unlikely, based on my experience, that this is a bubble,” Schmidt said during an appearance at the RAISE Summit in Paris. “It’s much more likely that you’re seeing a whole new industrial structure.”

Read the original article on Business Insider

Leave a Comment

Your email address will not be published. Required fields are marked *