European Magnet Maker Warns of Rare Earth Crisis Without Action

(Bloomberg) — Europe needs to take much more decisive action to slash reliance on Chinese rare earths to avert worse supply disruptions, according to a German magnet maker that’s just started a plant in the US.

Vacuumschmelze GmbH’s new facility in South Carolina is among the first to reach production in a planned wave of rare-earth magnet projects in America. Chief Executive Officer Erik Eschen contrasted US efforts to reshore supply chains with what he described as Europe’s far less urgent approach, both from government and in boardrooms.

Most Read from Bloomberg

“There’s a clear difference with the United States, which is leading the whole conversation,” Eschen said in an interview. “I would expect that the European politicians, as well as the industry, fall back into their sleeping mode and just wait for a solution that will come from the US or China.”

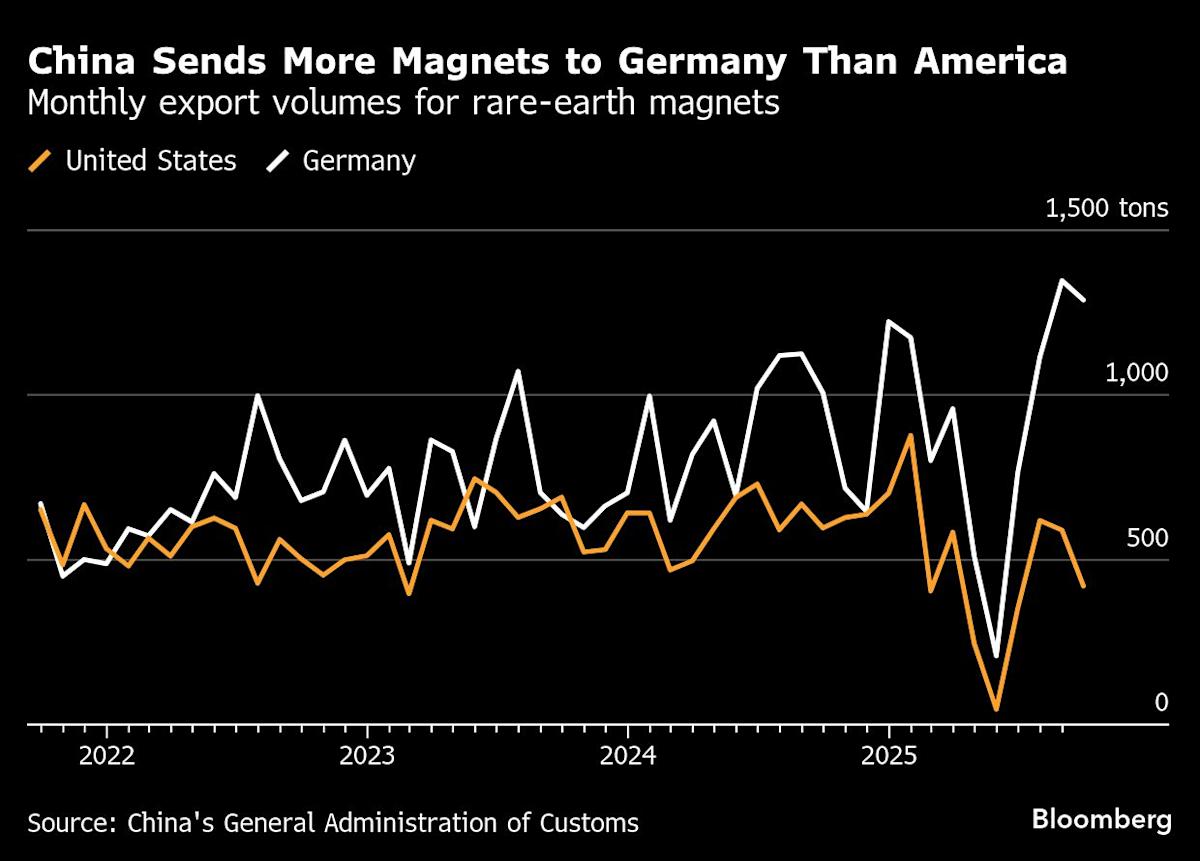

China’s export controls on rare earths were President Xi Jinping’s most potent weapon in the recent trade war with the Trump administration. But the curbs also embroiled other major economies, threatening industrial disruptions and spurring discussions about building alternative supply chains now that the two sides have agreed to a truce.

The US government has invested directly in MP Materials Corp. to create a national rare earths champion. It’s funding new domestic processing plants, while pledging cash for mines in Australia and Brazil. Treasury Secretary Scott Bessent, who attended the opening of Vacuumschmelze’s South Carolina plant, has said the US will go at “warp speed” to break its reliance on China.

“There’s a lot of know-how in Europe, but what we see right now is a lot of this is being transferred to the United States, to Canada, to Australia,” Eschen said last week. “We have to do something; otherwise we will lose our know-how, and in the longer term it’ll be disaster for Europe.”

Reliable Access

Vacuumschmelze, founded more than a century ago, has been making rare-earth magnets for more than 40 years. Its plant in Germany buys rare-earth “flake” from China and elsewhere, and uses the intermediate product to turn out the magnets vital for vehicles and electronic goods.

The European Union’s Critical Raw Materials Act, which came into force last year, is the continent’s strongest supply-chain legislation so far. But it’s been criticized for a lack of attention to funding, and the bloc has struggled to reach consensus on how to counter China.

Leave a Comment

Your email address will not be published. Required fields are marked *