The moment Home Depot dropped its Q3-2025 earnings (along with updated guidance), it wasn’t just Wall Street that took notice. If you’re running a one-truck or five-truck fleet, you should’ve been watching too. Because what Home Depot does in its stores and warehouses eventually shows up on the load board, in your balance sheet, and on your trailers.

Here’s why: When big retailers like Home Depot, Lowe’s and Walmart buy less inventory or slow distribution-center shipments, smaller trucking companies feel it first. The freight that used to move and “fill in” two weeks ago disappears. Deadhead creeps up. Rates soften. And the really savvy carriers prep accordingly.

Let’s unpack what Home Depot’s recent results say, how that ties into the broader retail‐freight ecosystem, and what you should be doing heading into Q1.

What Home Depot’s Numbers Are Saying

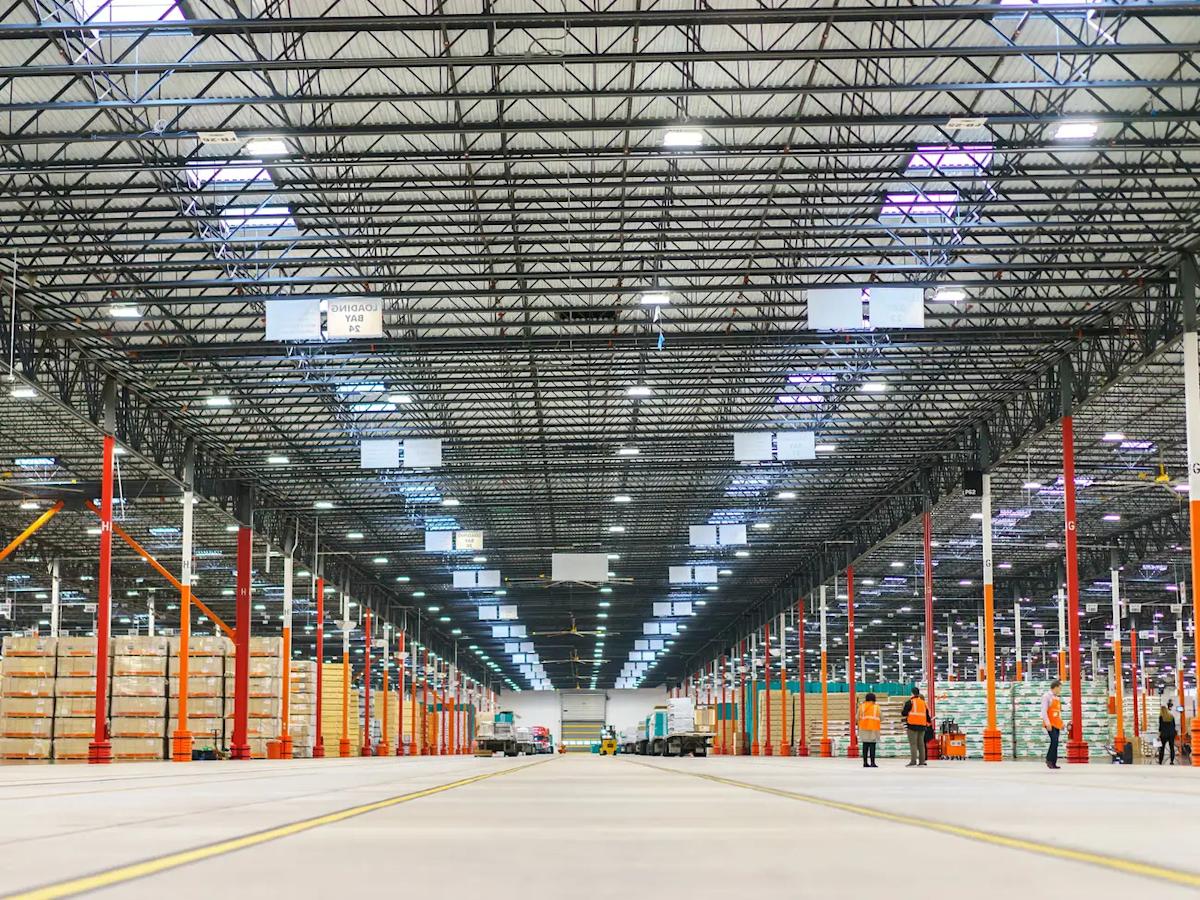

In Q3 2025 Home Depot reported comparable-sales growth (comparison store to store sales/same period) that disappointed expectations. They cited a slowdown in big-ticket home improvement projects, consumer caution, and an outlook that trimmed full-year forecasts. On the investor calls, supply-chain executives flagged that store inventories are elevated relative to demand—meaning less restocking and fewer truckloads destined for those big DCs or store replenishment systems.

Home Depot’s guidance reduction isn’t just about stores. It’s about warehouse throughput, about how much the distribution network needs to haul. If they expect fewer projects (which drive product sales), they buy and ship less.

Analysts noted the stock fell partially because earnings missed and guidance was weak, but also because the margin of safety for inventory investment just got smaller. Fewer loads today can mean less demand tomorrow.

For smaller carriers, the key takeaway is this: when a major retailer says they’re scaling back inventory or cutting back restocking, the freight corridors that support them contract—especially on the outbound side of product to distribution, and the inbound side of merchandise to stores. This will hit the contract side first and then spot right afterwards as the load count declines.

Why Inventory Matters

Think of inventory like the fuel behind freight. If stores and DCs are full of product already, why ship more? If they expect sales to slow, why order ahead? The answers matter for trucks.

When Home Depot mentions elevated inventory levels, it means their warehouses and stores may reduce future orders until they clear current stock. That leads to fewer truckloads hitting the boards from vendors, fewer warehouse-to-store moves, fewer returns and reposition loads.

Lowe’s and Walmart show the same kind of signals when they report that stock turns are slower or build stops. Smaller trucking firms don’t often work direct for these giants, but you ride the ripple. Your brokers and connections who run national retail chains will feel the softening and either reduce options or rate when they still need to haul.

For example: A vendor for Home Depot who used to schedule 200 loads a month to five regional DCs may cut to 120 loads. That’s 80 fewer chances for a smaller carrier to line up into that network, maybe cutting out some opportunities that you have hauled before as well as lowering rates.

What To Expect in Q1 For Freight Demand

If we map Home Depot’s signals to the trucking calendar, here’s what to watch:

-

Late Q4 / Early Q1 Slowdown: Inventory echoes from Q3 typically hit in Q4 into Q1. If Home Depot is slowing down now, Q1 will feel it in load counts.

-

Better opportunity in service or seasonal freight: Even when big‐box retail slows, maintenance, rebuilds and servicing shipments may still run. Smaller fleets that pivot to those niches can capture freight others abandon, but only if you don’t sit on your hands. You have to get to cold calling and building relationships without tunnel vision.

-

Regional variation matters: Home Depot’s national numbers hide regional strength or weakness. If your region has high housing starts or natural-disaster rebuild demand, you might see a micro-lift even if national numbers are flat. So don’t assume this means for everywhere. You will still see some regions shine and they won’t fall in the same bucket as the chain-wide sentiments.

-

Backhaul becomes harder: If outbound shipments slow from DCs, the return leg empties out. Expect more deadhead unless you proactively book repositions. We know you may hate that word, but especially lumber for flatbedders, typically is a reliable backhaul option.

-

Rate pressure possible: As load count softens and competition stays high, spot market rates may lag. Small carriers that rely on lost-and-found load board freight will need to fight harder for every dime.

The good news? While Home Depot isn’t predicting a crash, their outlook signals flat to modest growth—meaning survival and efficiency will matter more than chasing big jumps.

How Small Carriers Can Shift Their Focus

Here’s how you should adjust your playbook:

Track load board wins by segment

Don’t let “any freight will do” be your habit. Start tracking what kind of loads you win, the paying lanes, the return loads. If home improvement product is your bread-and-butter and the market shows weakness, diversify now. Use the “Blue to Blue” app to be sure you are positioned!

Get serious about backhaul planning

If you pick up outbound big loads to DCs now, book your return before you leave the shipper. Don’t presume you’ll find freight on the board. We like to say, “Book a Load, From A Load”.

Cost control is the safety net

Since volume may flatten, your profit comes from how little you spend when you haul. Fuel discipline, tire management, idle reduction, choose loads where accessorials and detention are reasonable. Remember how important it is to calculate your operating ratio and breakeven points. Also remember that they are very different..

Have a plan B ready early

If Q1 starts slow, you don’t want to scramble. Have a list of alternative freight types you can pivot into—regional, equipment parts hauling, short term contracts, government contracts, etc.

A Neutral Stance—but Not a Flipped Market

Let’s be upfront: Home Depot’s earnings and the signals from Lowe’s and Walmart do not necessarily mean “boom time” for truckers in Q1. They also don’t mean “collapse.” What they mean is:

-

The freight world is indicative of how people are using their wallets, not explosive without demand.

-

The risk of steeper decline may be less than feared, but the chance of big upside is also modest.

-

Truckers who prepare now will win; those who assume “business as usual” may get squeezed.

So yes: Keep your eyes open.

Expected outcome for many smaller carriers: Flat to slightly improved volumes, with capacity exits, however you need demand increases to really be to our favor long term.

Final Thought

Home Depot’s big earnings day becomes a somewhat crystal ball for you—but only if you read the story behind the numbers. When they say inventory is heavy, when they say consumer spending is cautious, you should hear: Less freight ahead in certain lanes. When they say guidance is trimmed, you should hear: Rates may stagnate or fall before they rise. Lowe’s will drop their earnings tomorrow and Walmart the day after.

You didn’t get into the trucking business to chase illusions. You’re here because you haul hard, manage tight, and make margins under pressure. As you head into Q1, let Home Depot’s report be a heads-up, not a hope. Plan your realities, pick your lanes, safeguard your margin.

Because when the big retailers move slower, the trucks that move smarter survive. And when things finally lift? You’ll be ready.

The post What Home Depot’s Q3-2025 Earnings May Tell Truckers About Freight in Q1 appeared first on FreightWaves.

Leave a Comment

Your email address will not be published. Required fields are marked *