China Dials Back Budget Spending by Most in Over Four Years

(Bloomberg) — China’s broad fiscal spending slumped in October by the most since at least 2021, crippling a key driver of investment and economic growth.

The combined expenditure in China’s two main budgets — the general public account and the government-managed fund book — tumbled 19% in October from a year earlier to 2.37 trillion yuan ($334 billion), according to Bloomberg calculations based on data released by the Ministry of Finance on Monday.

Most Read from Bloomberg

It was the steepest slide since comparable data started in early 2021, while the value of money spent was the least since July 2023. Goldman Sachs Group Inc. said its proprietary “augmented fiscal deficit” metric narrowed last month, indicating that budget policy “turned less supportive of growth.”

The plunge reflects an evolution of government policies and underlines waning fiscal support for the world’s second-largest economy, which lost steam across the board last month.

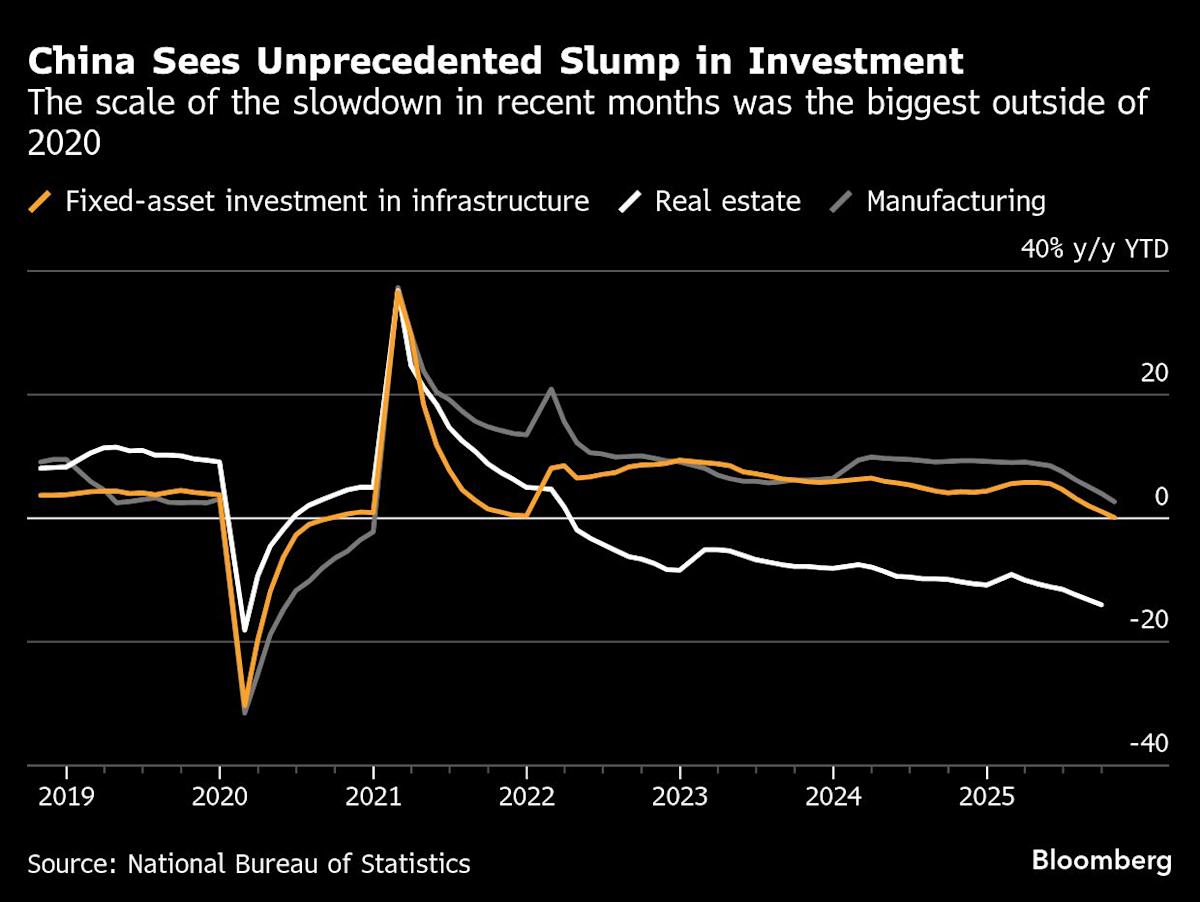

Investment, a large part of which is driven by budget expenditure, posted an unprecedented decline in October, adding to a drag from sluggish consumption and weaker foreign demand.

The “data suggest that the meaningful deceleration in government spending growth, together with a larger portion of incremental spending being spent on repaying corporate arrears — rather than investment projects — may have significantly weighed on headline fixed-asset investment growth,” Goldman economists including Lisheng Wang wrote in a note.

The contraction in budget spending also indicates that fresh stimulus added since late September will likely take time to trickle through the economy. The 500 billion yuan in new policy financing tools to spur investment was only fully deployed by the end of last month, the government has said.

Another 500 billion yuan in special local government bond quota was announced in mid-October, but only 40% of it was meant for qualified provinces to invest in projects. The move suggests Chinese authorities are leaning toward containing debt risks now that Beijing’s growth target of around 5% for this year looks safely within reach.

“Policymakers seem pleased about economic growth in 2025 and believe announced stimulus should allow them to hit this year’s target,” said Michelle Lam, Greater China economist at Societe Generale SA. Therefore, “markets are looking forward to fiscal support in 2026,” she said.

Leave a Comment

Your email address will not be published. Required fields are marked *