Oil’s Global Oversupply Shows Up Most Prominently in US Market

(Bloomberg) — Global crude oil markets are oversupplied, and it’s most obvious in the Americas, especially the US.

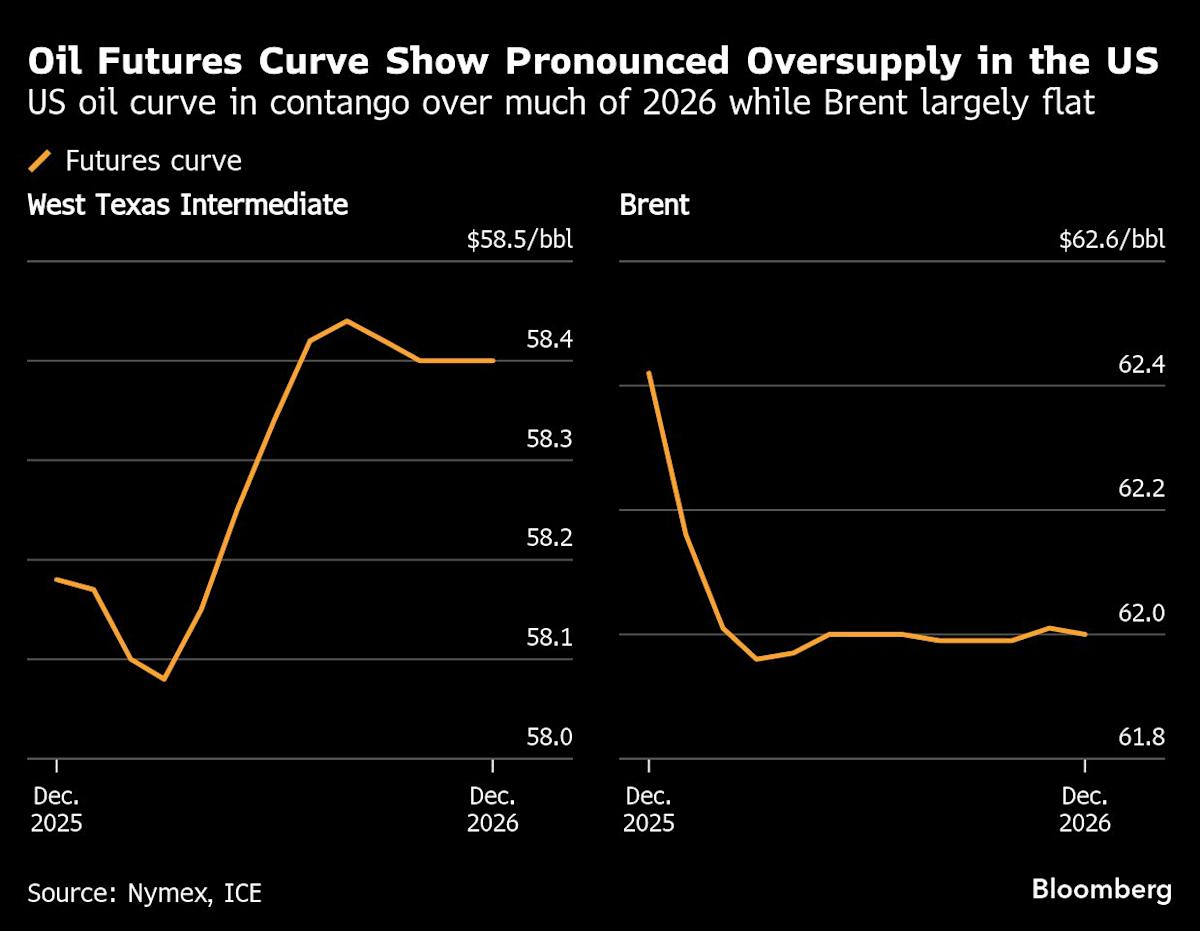

The futures curve for US benchmark West Texas Intermediate is in a contango structure — in which later-dated contracts trade at a premium to nearer ones — for most of 2026, suggesting weaker demand for prompt barrels. Further signs of healthy supply in the US can be seen in high export volumes. Crude exports for October came in at the highest since July 2024, according to government data.

Most Read from Bloomberg

The equivalent curve for global marker Brent, meanwhile, is largely flat in the months after March. The difference between the two reflects the varying degrees of oversupply that regional crude markets are experiencing.

A flat curve suggests demand for prompt Brent barrels is also lackluster. North Sea markets are flashing weakness; the Brent-Dubai EFS, a measure of its value against the Middle Eastern benchmark, was negative this week, indicating it was going at a discount.

Globally, market watchers are broadly expecting a glut next year. OPEC, which has long held the view that oil demand would remain healthy, flipped estimates in the third quarter from a deficit to a surplus on higher US production. The International Energy Agency, meanwhile, has said there would be a record surplus in 2026.

The world is set to be in a “slight surplus through this quarter and going into next quarter,” said Vandana Hari, founder of Singapore-based analysis firm Vanda Insights, on Bloomberg Television. “We may see continued flooding of the forward curve with contango, but I don’t expect a deep contango.”

–With assistance from Rong Wei Neo.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

Leave a Comment

Your email address will not be published. Required fields are marked *