Private sector employers warn over job cuts and hiring freeze

Britain’s private sector is expected to accelerate jobs cuts and freeze recruitment following the Budget as employment costs weigh on businesses, according to a new study.

On Tuesday, the Confederation of British Industry’s (CBI) monthly survey for November showed bosses expect to reduce both hiring and the number of roles over the next three months amid a continued slump for the private sector.

With a decline now pencilled in until at least February, it means private sector activity has been falling for over a year. CBI data show that business hiring intentions started to dip into negative territory in November 2024 – and have maintained the decline since then.

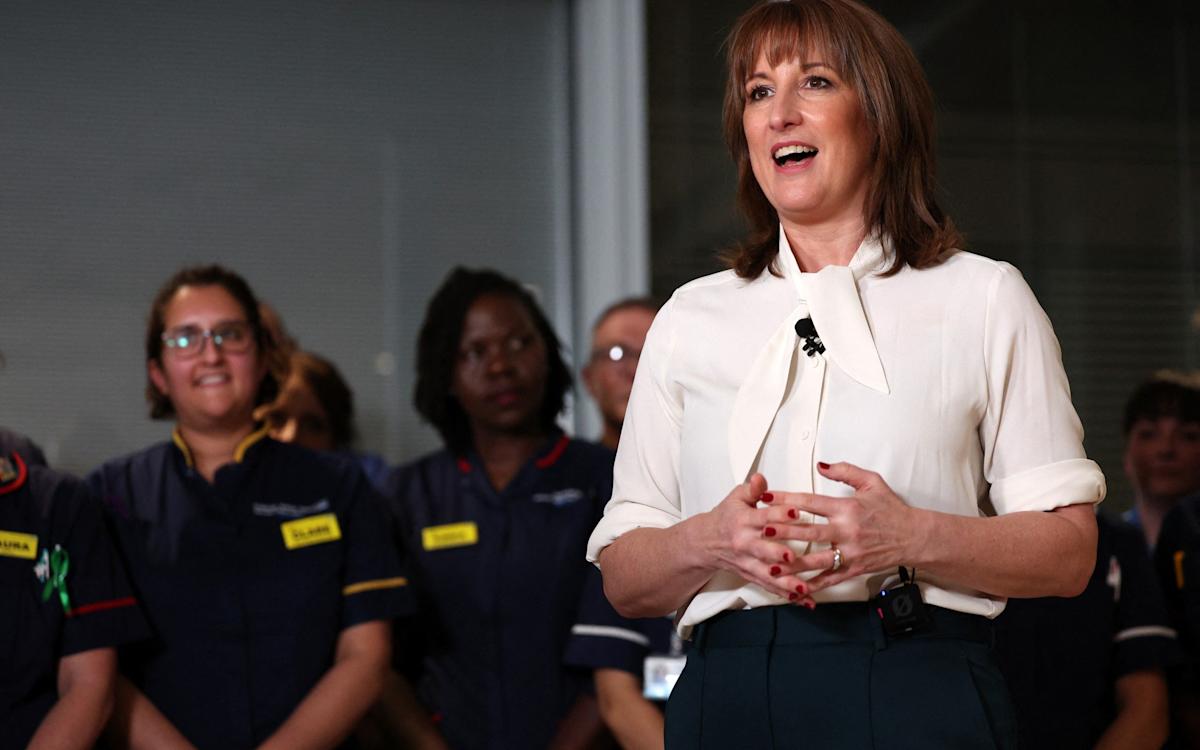

Private sector companies have also reduced their headcount over the past year after Rachel Reeves’s £40bn tax raid in her 2024 Budget raised labour costs and hammered business confidence, the survey showed.

Britain’s private sector is poised to shrink at the fastest rate since August 2020 as businesses expect a slowdown in activity, the CBI survey revealed. It has been over a year the CBI recorded a positive reading for future expectations in the private sector.

According to the latest poll, which had 909 respondents and was conducted before the Budget, the consumer services and manufacturing sectors were shown to be facing the sharpest decline in activity over the next three months.

Alpesh Paleja, the deputy chief economist at the CBI, said that uncertainty ahead of the Budget had caused many businesses to hold back on hiring and investment decisions.

He added that businesses had faced a backdrop of “persistent cost pressures” throughout the year.

Businesses have repeatedly warned of job losses after the Chancellor raised employers’ National Insurance contributions (NICs) and increased the minimum wage.

Figures from the Office for National Statistics (ONS) showed that the unemployment rate climbed to 5pc in the three months to September, up from 4.3pc during the same period in 2024 as the job market cooled and companies froze recruitment.

The situation is unlikely to improve anytime soon after Rachel Reeves announced the minimum wage for those 21 and over would rise an inflation-beating 4.1pc to £12.71 from April 2026. For workers aged 18 to 20 the minimum wage will climb to £10.85, a 8.5pc increase.

The significant increase in the minimum wage for workers under 21 comes despite warnings that it will price young people out of work.

The UK is already grappling with a youth worklessness crisis as official figures show there were 946,000 people aged 16 to 24 who are not in employment, education or training (Neet) in the three months to September.

Leave a Comment

Your email address will not be published. Required fields are marked *